Download PDF | View documents on Sedar

Vancouver, BC – FJORDLAND EXPLORATION INC. (“Fjordland” or the “Company”– TSX Venture Exchange “FEX”) is pleased to announce that it has entered into an agreement with Quebec Precious Metals Corporation (“QPM”) to acquire 100% of the Renzy nickel copper project (the “Property”), also known as the Vulcain project.

Highlights:

- Option to acquire 100% interest in the Renzy nickel copper deposit

- High grade intercepts identified including 10.8 m of 1.3% nickel and 1.8% copper drilled in 2005

(Hole RZ-05-11) - Historical NI-43-101 compliant resource estimate demonstrates nickel-copper prospectivity for the 86 km2 property

- Previous geophysical surveys to be reinterpreted to generate new drill targets

- Opportunity for larger mineralized bodies at depth. Limited number of drill intercepts deeper than 100m

The Option Agreement (the “Agreement”) with QPM (the “Optionor”) allows Fjordland (the “Optionee”) to earn a 100% interest in 68 mineral claims in Hainaut Township, Quebec by paying to the Optionor a total amount of $50,000 in cash, issuing 1,000,000 Fjordland common Shares and by incurring $1,000,000 in exploration expenditures on the Property over a period of five years. As well, the Property is subject to a 1% Net Smelter Return royalty (the “Royalty”) to be retained by the Optionor provided that the Optionee shall have the right at any time to purchase back one-half percent of the Royalty for the sum of $500,000 and the second one-half percent of the Royalty for the sum of $2,500,000. Fjordland is also assuming the 2% pre-existing net smelter royalties (“NSR”) to underlying parties. Each one-half percent of the NSR can be repurchased at any time for $250,000. As a result, all the overriding royalties can be retired for $4,000,000 at any time. The Agreement is subject to TSX Venture Exchange approval upon which the cash payment and share issuance will be made within three (3) days.

In conjunction with the transaction, the Company has staked an additional 79 claims along the south eastern margins of the Property. As a result, the total project area now measures approximately 86 km2 and covers the 2004 magnetic and electromagnetic AeroTEM II surveys flown by Aeroquest Limited.

James Tuer, Fjordland’s President commented, “The Renzy project meets the Company’s exploration mandate of maximizing opportunity by minimizing political, geological and financial risk. The project is located in one of the best mining jurisdictions in the world. It has a proven endowment of high-grade mineralization and exploration and development costs can be minimized due to its ease of access. We believe there is tremendous exploration potential and have staked additional claims to incorporate the Renzy Shear Zone to the south on the speculation that it could represent a feeder zone at depth. We plan on employing our access to a state of the art geophysical team to maximize the potential of this unique opportunity.”

About the Renzy Property

The Project, including the Renzy Mine nickel copper deposit, is located in Hainaut Township, Outaouais, Quebec. The area is easily accessed year-round by vehicle 250 km north of Ottawa and 350 km north west of Montreal. The topography is generally flat and the bedrock is covered by up to 30 m of overburden on the majority of the area.

The Renzy Mine deposit was found outcropping on an island within Lake Renzy in 1955. An open pit mine to a maximum depth of 30 m from rock surface previously existed on the property. During the production period from 1969 to 1972, 716,000 short tons were mined with average grades of 0.70 % Nickel and 0.72 % Copper. The concentrates were shipped to Falconbridge facilities in Sudbury. The mine closed when Falconbridge failed to renew the concentrate purchase agreement due to a lagging economy and surplus nickel in world markets.

The Renzy Mine deposit contains, as defined by NI 43-101, Standards for Disclosure for Mineral Projects, a historical mineral resource estimate including indicated resources of 51,000 tonnes 0.79% Ni and 0.72% Cu and inferred resources of 280,000 tonnes at 0.82% Ni and 0.89% Cu with a cut-off grade of 0.7 % Ni equivalent. The resource is taken from a technical report filed on SEDAR entitled “Technical Report – Resources Evaluation November 2007 Vulcain Property, Hainaut township.” prepared for Matamec Explorations Inc.(“Matamec”) by Geostat Systems International Inc. and dated November 22, 2007. Matamec merged with QPM in 2018. See “Mineral Resource Statement” below.

In 2005, Matamec drilled a grid of 19 vertical holes averaging 80 m in depth along strike of the original mine. Examples of higher-grade intercepts are as follows:

Drill Hole

| Intercept (m) | Ni (%)

| Cu (%)

| Co (%)

| PGM+Au (g/T)

|

RZ-05-01

| 2.3

| 1.0%

| 1.1%

| 0.05%

| 0.19

|

RZ-05-05

| 3.0

| 1.0%

| 1.6%

| 0.05%

| 0.24

|

RZ-05-07

| 4.9

| 2.1%

| 1.7%

| 0.15%

| 0.32

|

RZ-05-10

| 3.0

| 1.9%

| 4.1%

| 0.14%

| 0.55

|

RZ-05-11

| 10.8

| 1.3%

| 1.8%

| 0.09%

| 0.22

|

RZ-05-14

| 14.7

| 1.0%

| 1.2%

| 0.07%

| 0.28

|

Note: refer to Matamec’s Press Release dated September 26, 2007 titled “Matamec Doubles Mineral Resources at Vulcain”

In 2008, Matamec drilled 40 short holes averaging 75 m targeting Induced Polarization (“IP”) anomalies and tested 6 of the 18 areas identified as geophysical target zones based on IP surveys. Results were not press released. The remaining 12 areas have had no exploration conducted over them.

Exploration Potential

The original mineral emplacement model suggested that all mineralization would be near surface. As a result, only shallow targets were explored. Drilling campaigns occurred in 1956, 2005 and 2008. The mid-20th century holes were conducted with AX and EX diameter (approx. 1”) drill holes down to approximately 32 m as an exploration tool. The later programs targeted the original pit area and certain other localized areas where bedrock outcrops showed promising chemistry. Newer exploration models of magma emplacement suggest that deeper targets are possible.

The Renzy deposit claim group lies at the south western end of the Renzy Terrane just north of the Renzy Shear Zone within the Grenville Province of the Canadian Shield. The location of the shear zone and the overall quantity of mafic/ultramafic rocks that carry sulfides with elevated concentration of Ni, Cu, and PGM’s bodes well for finding additional deposits.

About Fjordland Exploration Inc.

Fjordland Exploration Inc. is a mineral exploration company that is focused on the discovery of large-scale economic deposits located in Canada. Fjordland has been actively exploring two high quality nickel projects.

In collaboration with HPX and Commander Resources, Fjordland is exploring the South Voisey’s Bay “Pants Lake Intrusive” target which is a Ni-Cu-Co deposit analogous to the nearby Voisey’s Bay deposit located approximately 80 km to the north.

Fjordland has been granted an option by CanAlaska Uranium to earn an interest in the North Thompson Nickel Belt project, situated 20 km north of Vale’s long-life Thompson mine located in northern Manitoba. The project is considered prospective for Ni-Cu-Co-PGE magmatic sulphide mineralization analogous to the deposits hosting the historic mine. The Company is earning into an initial 49% interest in the project by spending $1.5 million by May 2022.

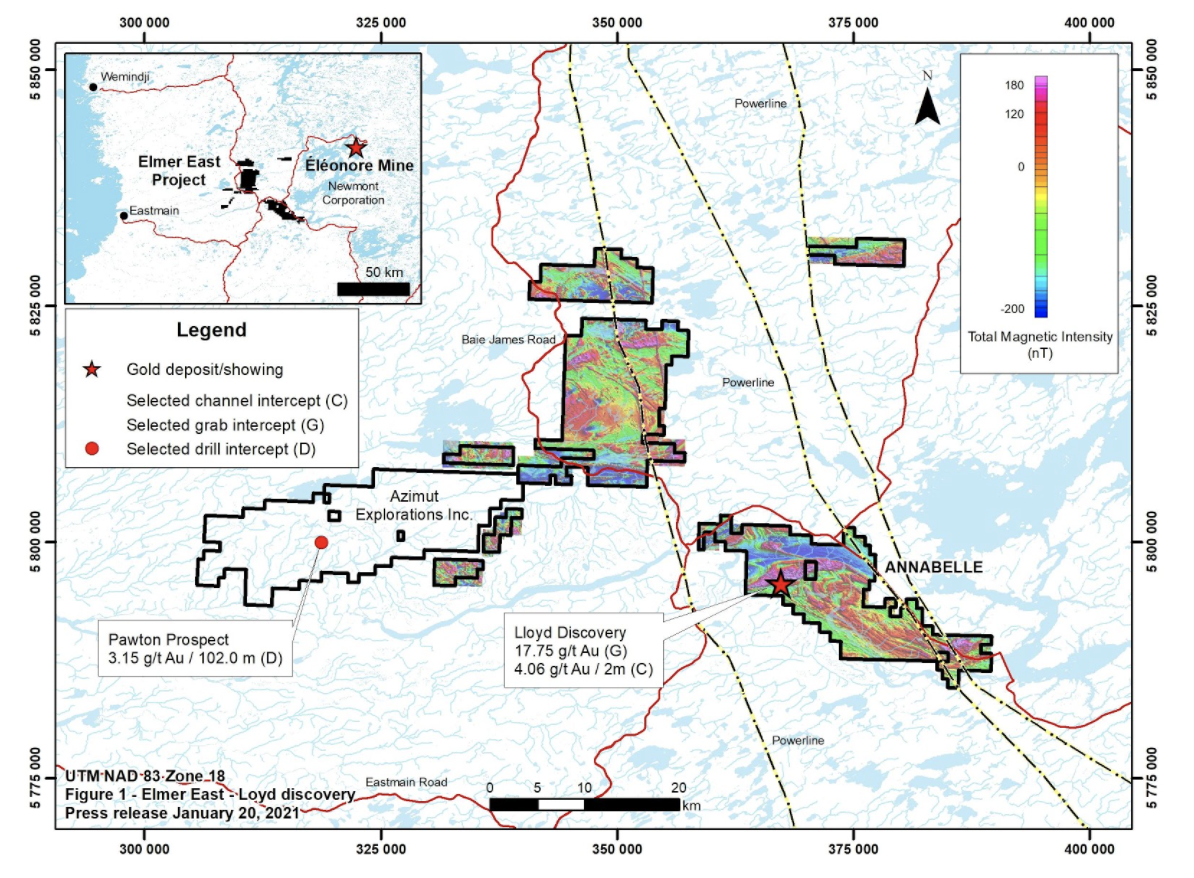

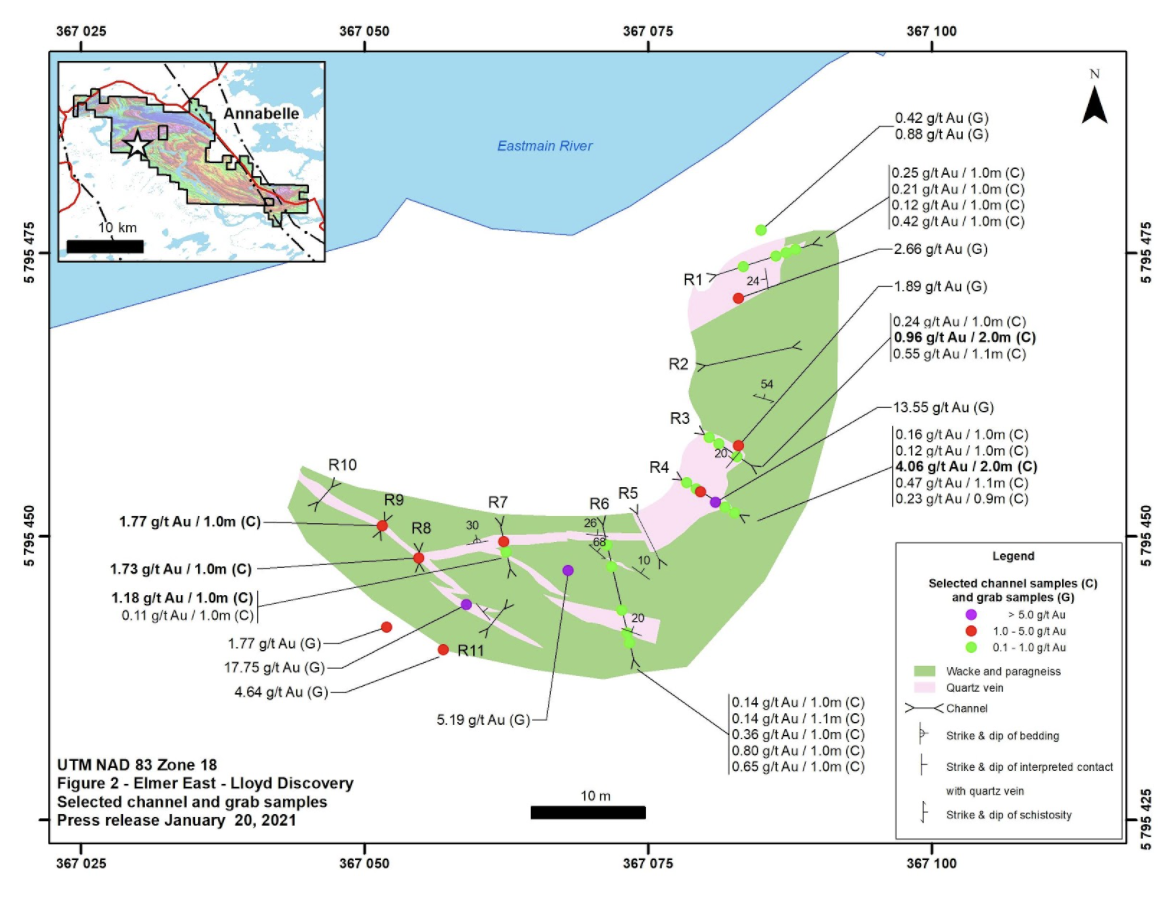

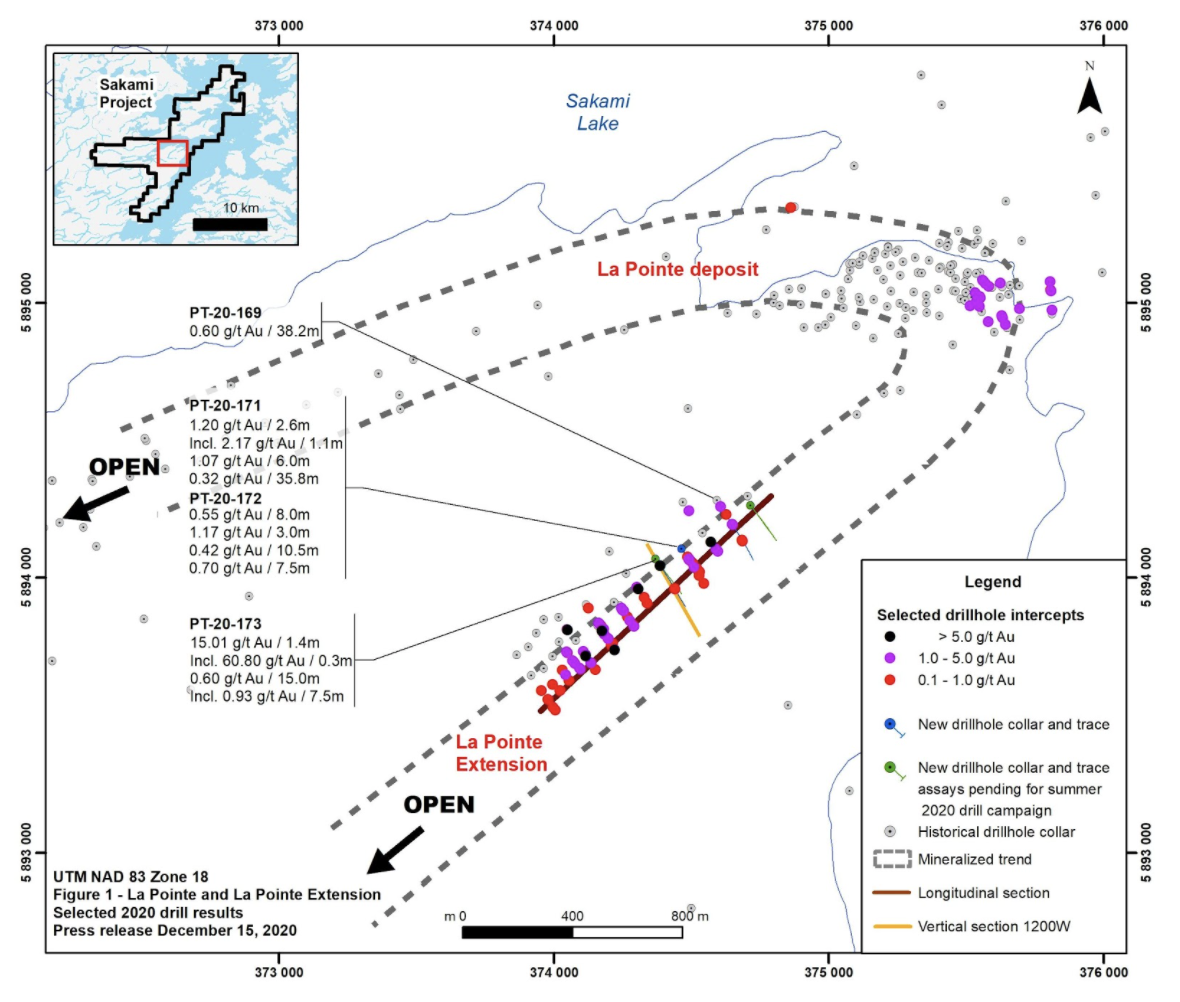

About Quebec Precious Metals Corporation

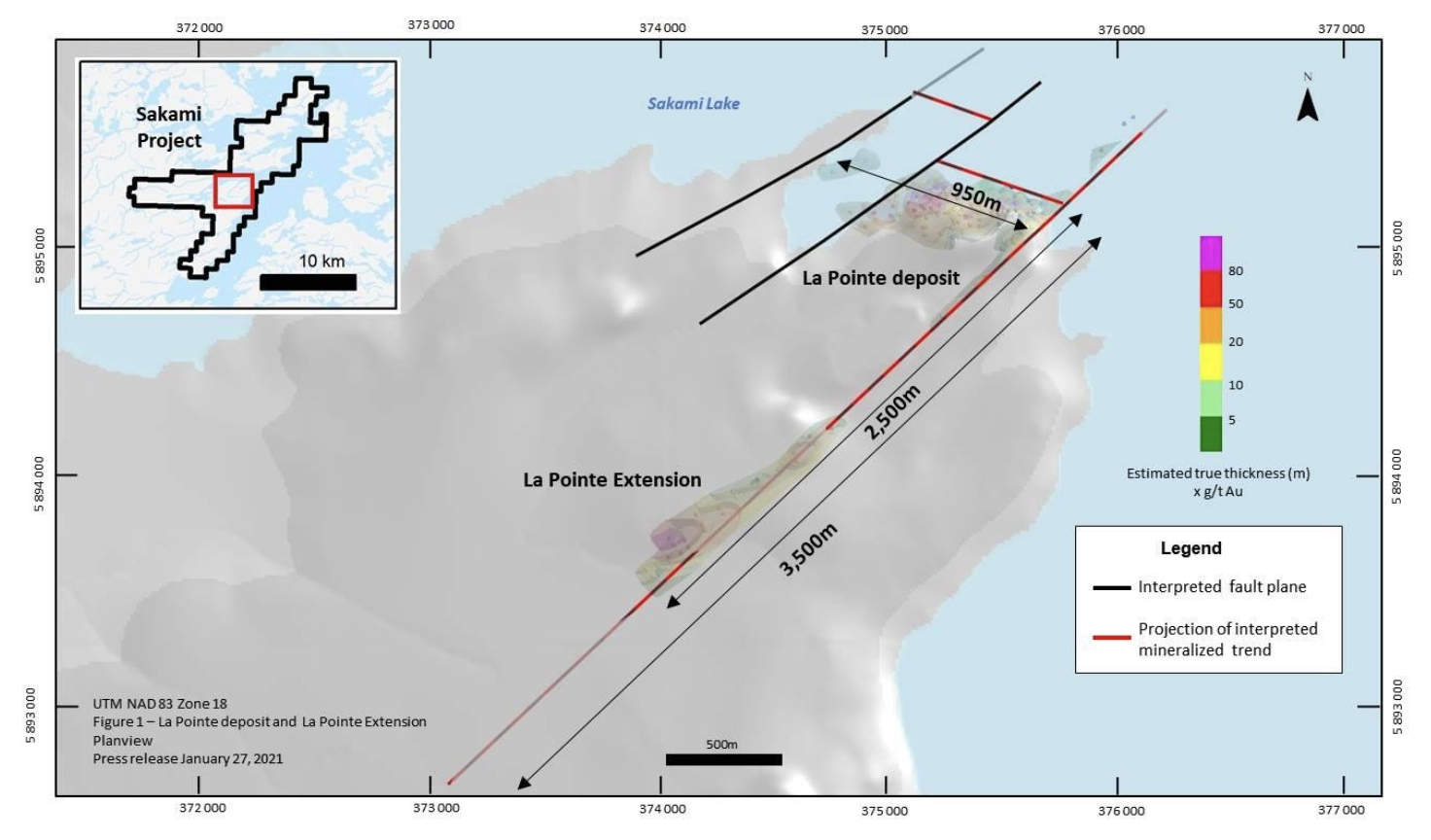

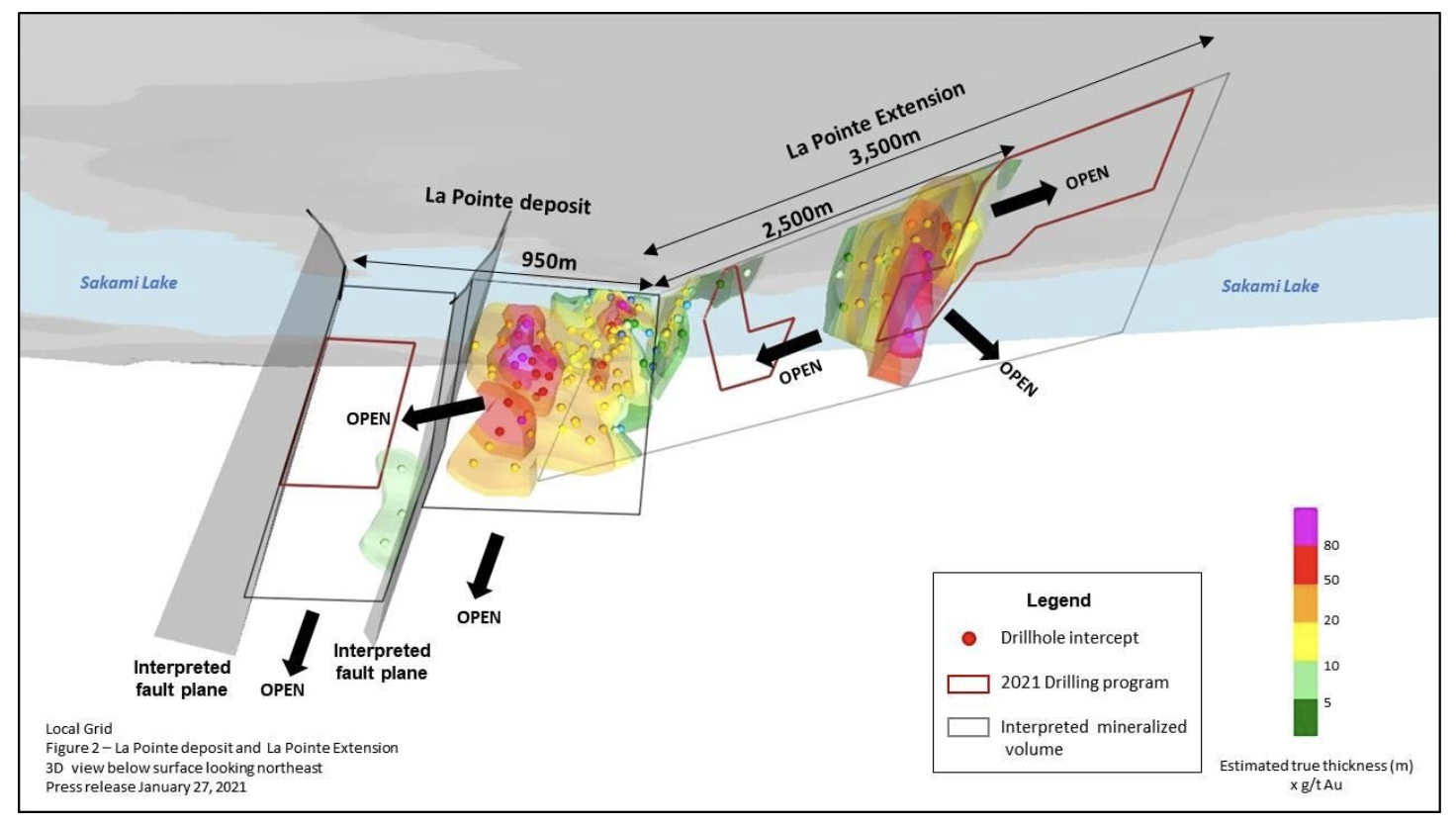

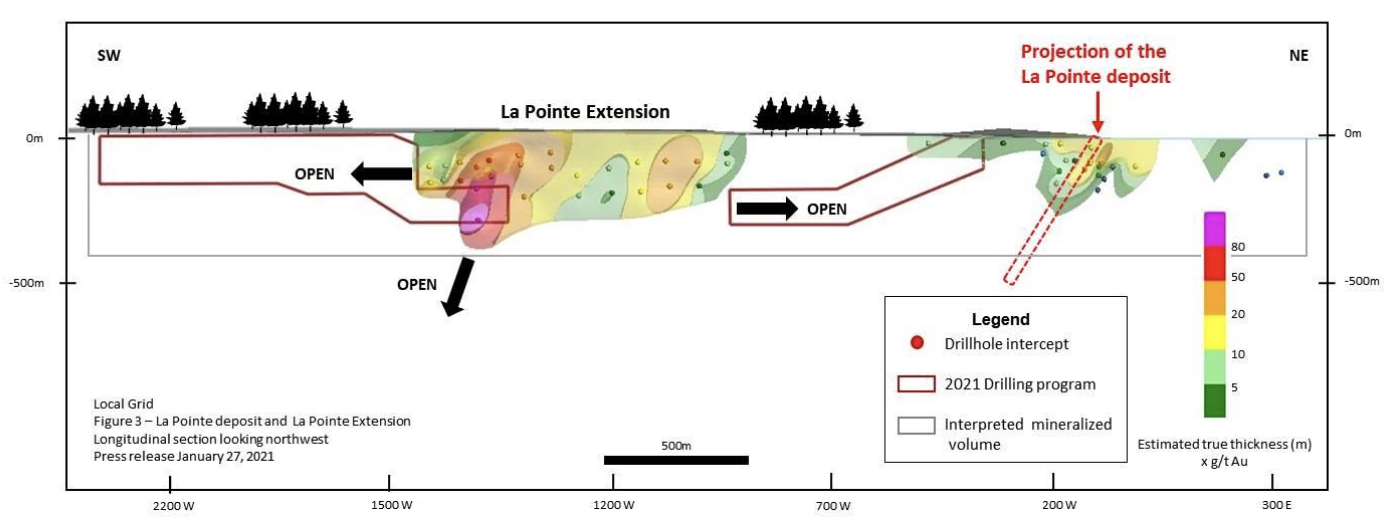

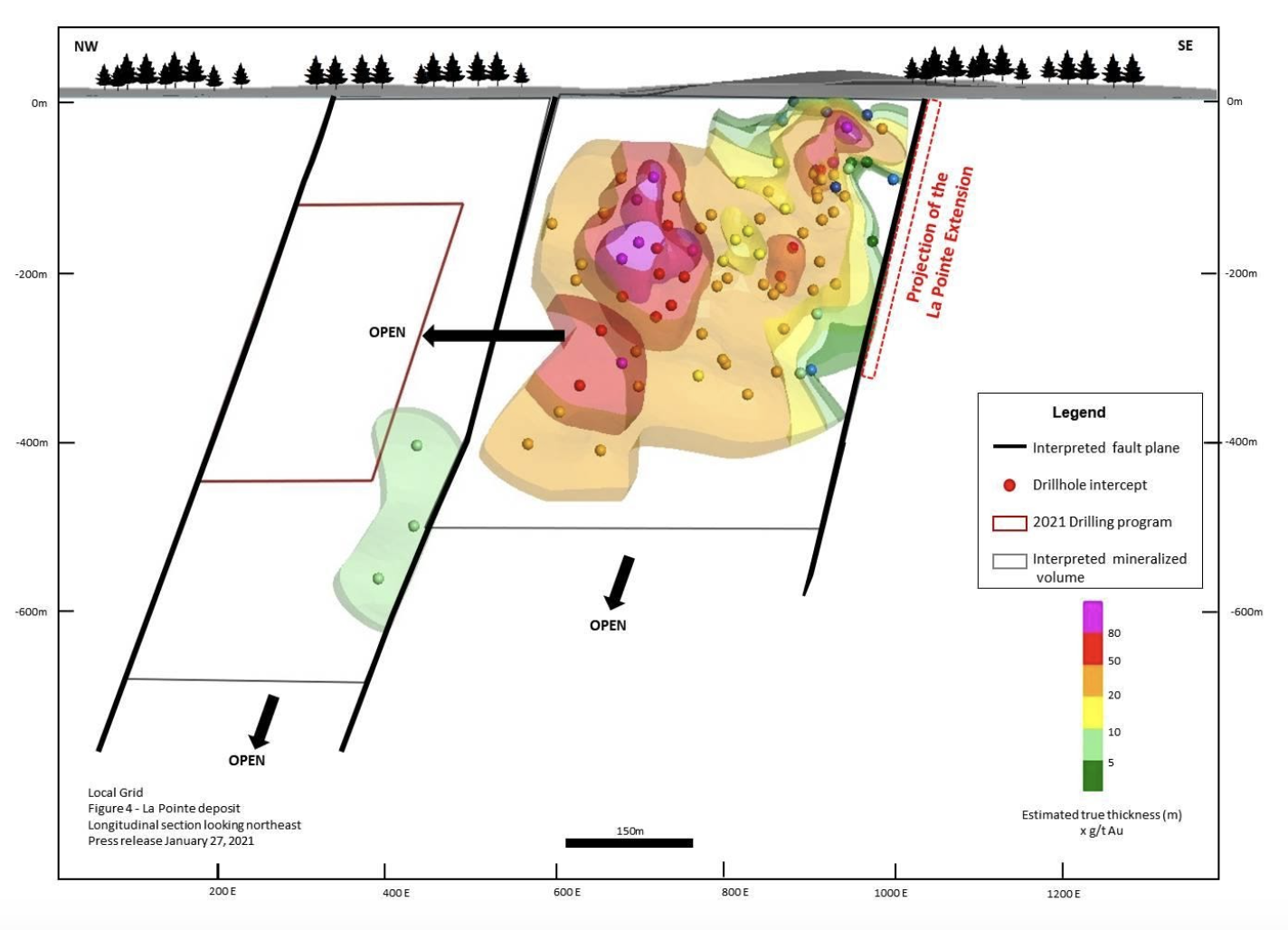

QPM is a gold explorer with a large land position in the highly-prospective Eeyou Istchee James Bay territory, Quebec, near Newmont Corporation’s Éléonore gold mine. QPM’s flagship project is the Sakami project with significant grades and well-defined drill-ready targets. QPM’s goal is to rapidly explore this Project to advance it to the mineral resource estimate stage.

Mineral Resource Statement

The classification of Mineral Resources and Mineral Reserves used in the report relied on the definitions provided in National Instrument 43-101, which came into effect on February 1, 2001. They further confirmed that they followed the guidelines adopted by the Council of the Canadian Institute of Mining Metallurgy and Petroleum for CIM Standards/NI 43-101. For the model, 251 of the 425 holes (and 1988 of the 2023 assays) that are located near the zone were used. In October 2004, Geostat Systems International Inc. (“Geostat”) verified and validated the 406 diamond drill holes made before the 2005 Matamec drill program (RZ-05 series holes). Elevation of the 406 drill holes are very imprecise and location of holes are somewhat imprecise especially far from the old mine. These drill holes come from archives (maps, logs, sections, etc.). Geostat considered the data valid enough to proceed with the estimation of resources of the inferred category. The hole information from the 19 2005 holes was considered precise enough to calculate indicated or measured resources providing that the quantity of data was sufficient.

The geological model was made on 20 sections. As described in the document “Estimation of Mineral resources and Mineral Reserves – Best Practice Guidelines” adopted by the CIM Council in 2003, the interpretation is then sliced again in another direction in order to verify the spatial continuity of the geological model. Slices were modelled on horizontal slices each being 5 m thick. The model measures approximately 750 m long by 70 m wide by 10 to 50 m thick.

A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource based on revised practices as per CIM (2014) and should not be treated or relied upon as such. The company considers the NI 43-101 report to be relevant given that no additional work of significance has been completed on the deposit since the issuance of the historical mineral resource estimate.

Robert Cameron, P. Geo., a technical advisor to the Company, is a qualified person within the context of National Instrument 43-101 and has read and takes responsibility for the technical aspects of this release. For further technical information please visit Fjordland’s website at www.fjordlandex.com

ON BEHALF OF THE BOARD OF DIRECTORS

“James Tuer”

James Tuer, President

For further information:

James Tuer

Ph: -604-688-3415

info@fjordlandex.com

www.fjordlandex.com

Forward-Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this news release, including, without limitation, statements regarding the use of proceeds from the private placement, and other future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s plans or expectations include market prices, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.