Download PDF | View documents on Sedar

MONTREAL and TORONTO, Canada – April 28, 2025 – FURY GOLD MINES LIMITED (TSX: FURY, NYSE American: FURY) (“Fury”) is pleased to announce the successful completion of its previously announced transaction with Québec Precious Metals Corporation (“QPM”), previously announced on February 26, 2025, whereby Fury acquired all of the issued and outstanding common shares of QPM (the “QPM Shares”) pursuant to a court-approved plan of arrangement under the Canada Business Corporations Act (the “Arrangement”).

Pursuant to the Arrangement, former shareholders of QPM received 0.0741 of a common share of Fury (each whole common share of Fury, a “Fury Share”) for each QPM Share held (the “Exchange Ratio”). As a result of the Arrangement, Fury issued an aggregate of 8,394,137 Fury Shares as of the completion of the Arrangement. In addition, options and warrants of QPM that were outstanding as at the time of completion of the Arrangement are now exercisable for Fury Shares on substantially the same terms and conditions, with the number of Fury Shares issuable on exercise and the exercise price adjusted in accordance with the Exchange Ratio.

Transaction Highlights:

- Deliver increased scale and enhanced diversification with the addition of several prospective gold and critical minerals exploration assets located in Quebec.

- Provide synergy and cost savings with Fury’s board and management team with a track record of capital raising, discovery, exploration success, and community engagement leading the combined company.

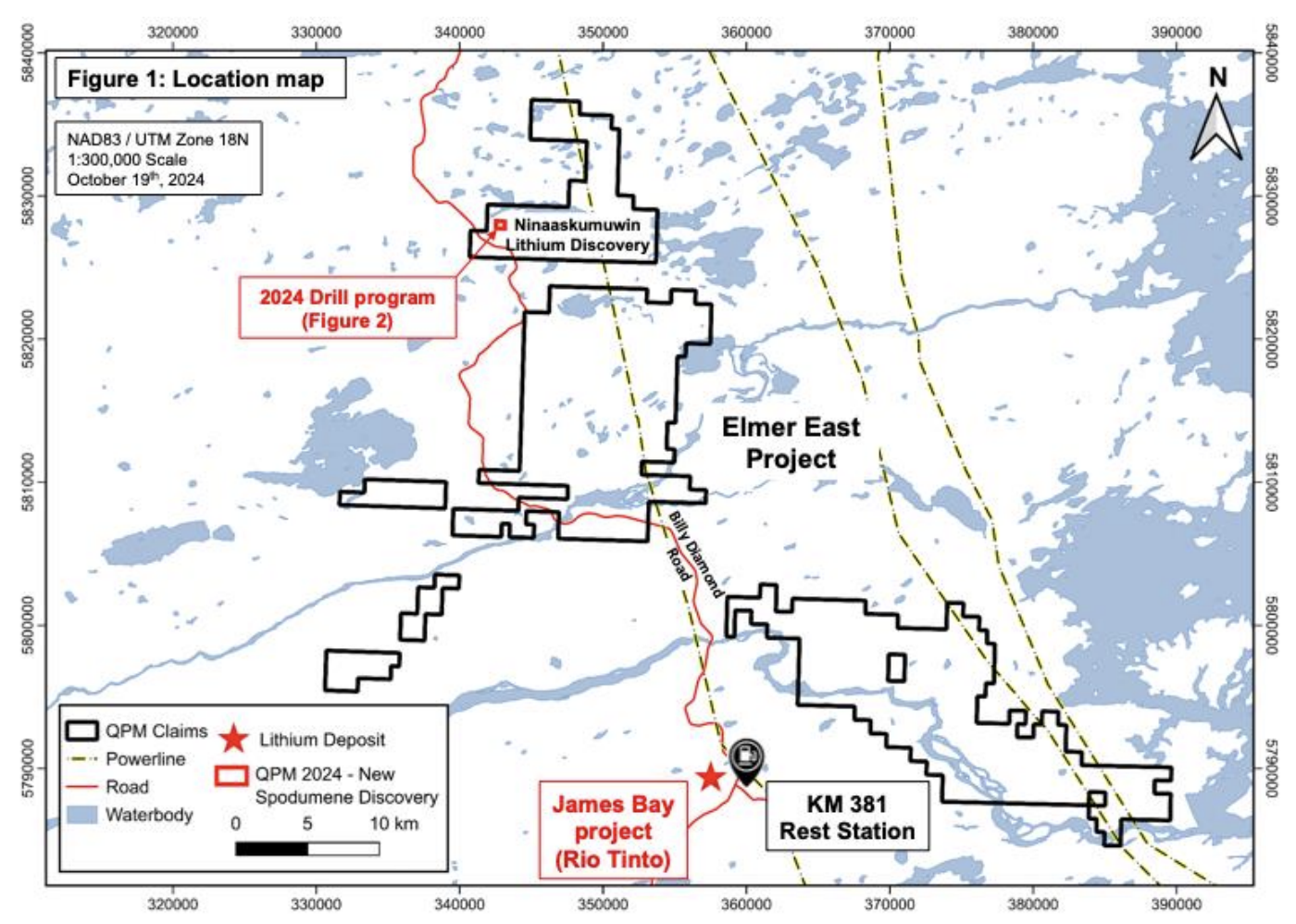

With the completion of the acquisition of QPM, Fury now owns a gold and critical mineral exploration portfolio totaling over 157,000 hectares in Québec. The properties acquired by Fury pursuant to the Arrangement include the Sakami project, the Elmer East project, and the Kipawa project. For further details with respect the projects of QPM, refer to the news release dated February 26, 2025.

Tim Clark, CEO of Fury commented: “We are pleased to officially complete this transformative transaction, which doubles Fury’s footprint in the Eeyou Istchee James Bay territory. The integration of QPM’s high-potential gold and critical minerals assets with Fury’s existing portfolio and strong financial position creates a more robust platform for exploration and growth. We believe the combined strengths of our teams and resources will drive greater operational efficiency and unlock long-term value for shareholders.”

Normand Champigny, CEO and Director of QPM, commented: “Completing this transaction with Fury marks an exciting new chapter for QPM’s shareholders. With access to Fury’s strong leadership, financial resources, and permitting expertise, we are confident in the enhanced ability to accelerate exploration efforts at Sakami and beyond. This combination validates the work accomplished to date and positions the assets for meaningful advancement, offering significant upside potential in today’s supportive gold market.”

Trading of the QPM Shares on the TSX Venture Exchange (the “TSXV”) has been halted and will remain halted until the QPM Shares have been delisted from the TSXV, which is expected to be on or approximately by April 30, 2025. The QPM Shares will also be delisted from the Frankfurt Stock Exchange. Following the delisting, QPM intends to submit an application to the applicable securities regulators in Canada to cease to be a reporting issuer.

In connection with the Arrangement, Fury will file a report on its SEDAR+ profile at www.sedarplus.ca pursuant to National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues containing additional information respecting the foregoing matters. A copy of such report may be obtained by contacting Margaux Villalpando, Investor Relations of Fury at (844) 601-0841.

McMillan LLP is acting as Canadian legal advisor to Fury and BCF Business Law is acting as Canadian legal counsel to QPM in connection with the Arrangement.

About Fury Gold Mines Limited

Fury Gold Mines Limited is a Canadian-focused exploration company positioned in two prolific mining regions across the country and holds an approximate 12.8 million common share position in Dolly Varden Silver Corp. (approximately 16% of issued shares). Led by a management team and board of directors with proven success in financing and advancing exploration assets, Fury intends to grow its multi-million-ounce gold platform through rigorous project evaluation and exploration excellence. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining. For more information on Fury Gold Mines, visit www.furygoldmines.com.

About Quebec Precious Metals Corporation

QPM has a large land position in the highly prospective Eeyou Istchee James Bay territory, Quebec, near Dhilmar Ltd’s Éléonore gold mine (formerly owned by Newmont Corporation). QPM focuses on advancing its Sakami gold project and its newly discovered, drill-ready Ninaaskuwin lithium showing on the Elmer East project. In addition, QPM holds a 68% interest in the Kipawa rare earths project located near Temiscaming, Quebec.

Neither the TSX nor its Regulations Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this news release.

For further information on Fury Gold Mines Limited, please contact:

Margaux Villalpando, Investor Relations

Tel: (844) 601-0841

Email: info@furygoldmines.com

Website: www.furygoldmines.com

For more information about QPM, please contact:

Normand Champigny, Chief Executive Officer

Tel.: (514) 979-4746

Email: nchampigny@qpmcorp.ca

Cautionary Statements

The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold within the United States or to, or for the account or the benefit of, U.S. persons (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

This press release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events. These particularly pertain to statements with respect to remarks with respect to the potential of the combined companies and recently acquired properties and QPM obtaining the necessary approvals and delisting from the TSXV and the Frankfurt Stock Exchange and to cease to be a reporting issuer in Canada.

Fury and QPM have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information including but not limited to those arising from general economic conditions; adverse industry events; volatility in commodity prices; future legislative and regulatory developments; and other risks described in our recent securities filings available at www.sedarplus.ca.

There may also be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place heavy reliance on forward-looking information. Neither Fury nor QPM undertake to update any forward-looking information except in accordance with applicable securities laws.

No regulatory authority has approved the contents of this news release.

- April 28, 2025 Fury Gold Mines Completes Acquisition Of Quebec Precious Metals Corporation

- April 22, 2025 Quebec Precious Metals Announces Shareholder Approval of Arrangement with Fury Gold

- April 09, 2025 The Cree Trappers Association, the Cree Hunters Economic Security Board and Mining & Exploration Companies Approve 2025 Funding to Continue the Reconstruction of Cabins Burnt during the 2023 Forest Fires, James Bay, Quebec

- March 26, 2025 Fury Gold Mines and Quebec Precious Metals Update Merger Process

- February 26, 2025 Fury Gold Mines Limited to Acquire Quebec Precious Metals Corporation

- January 17, 2025 Quebec Precious Metals Receives Payment of $200,000 from the Sale of Non-Core Asset in Ontario

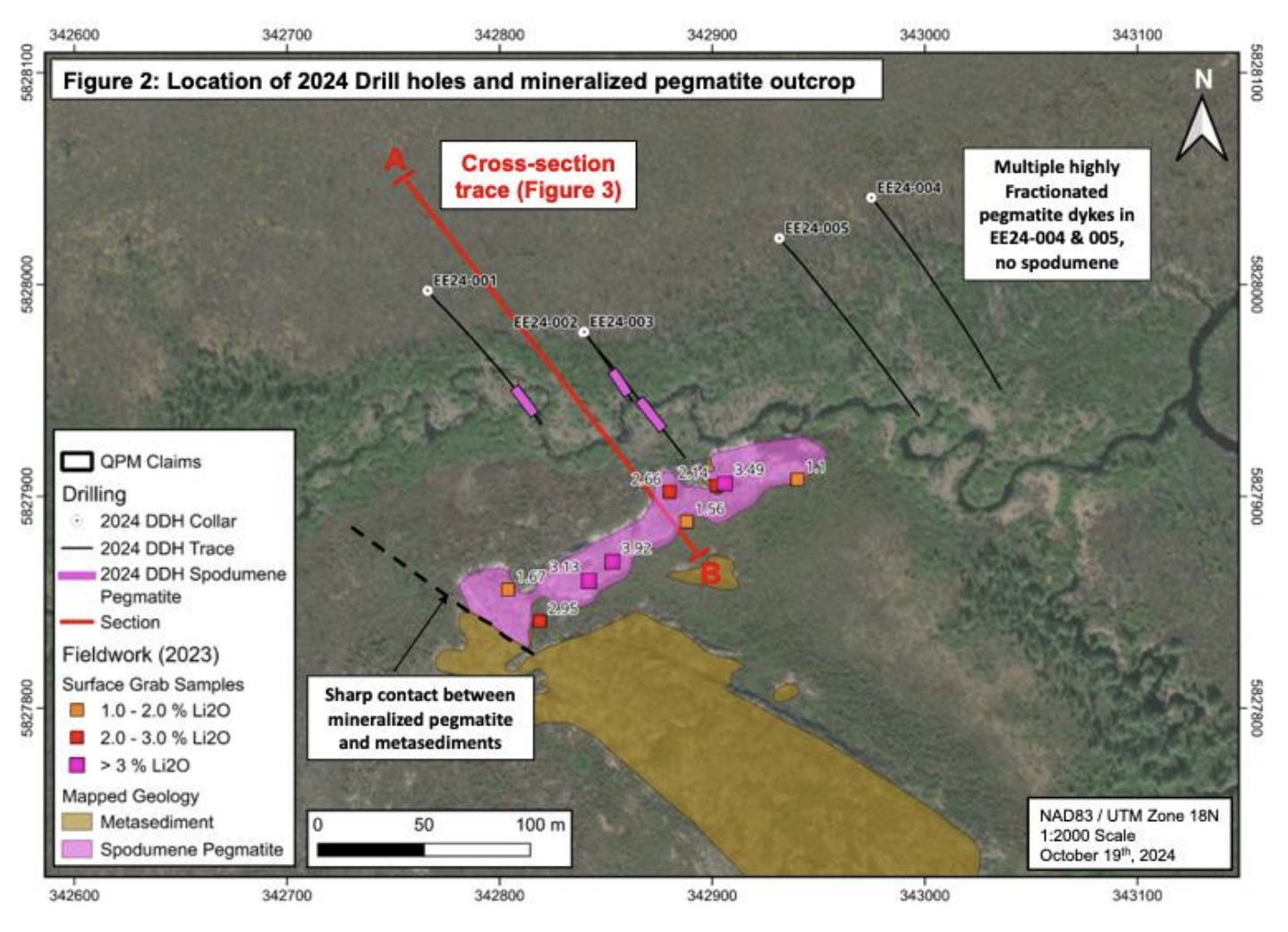

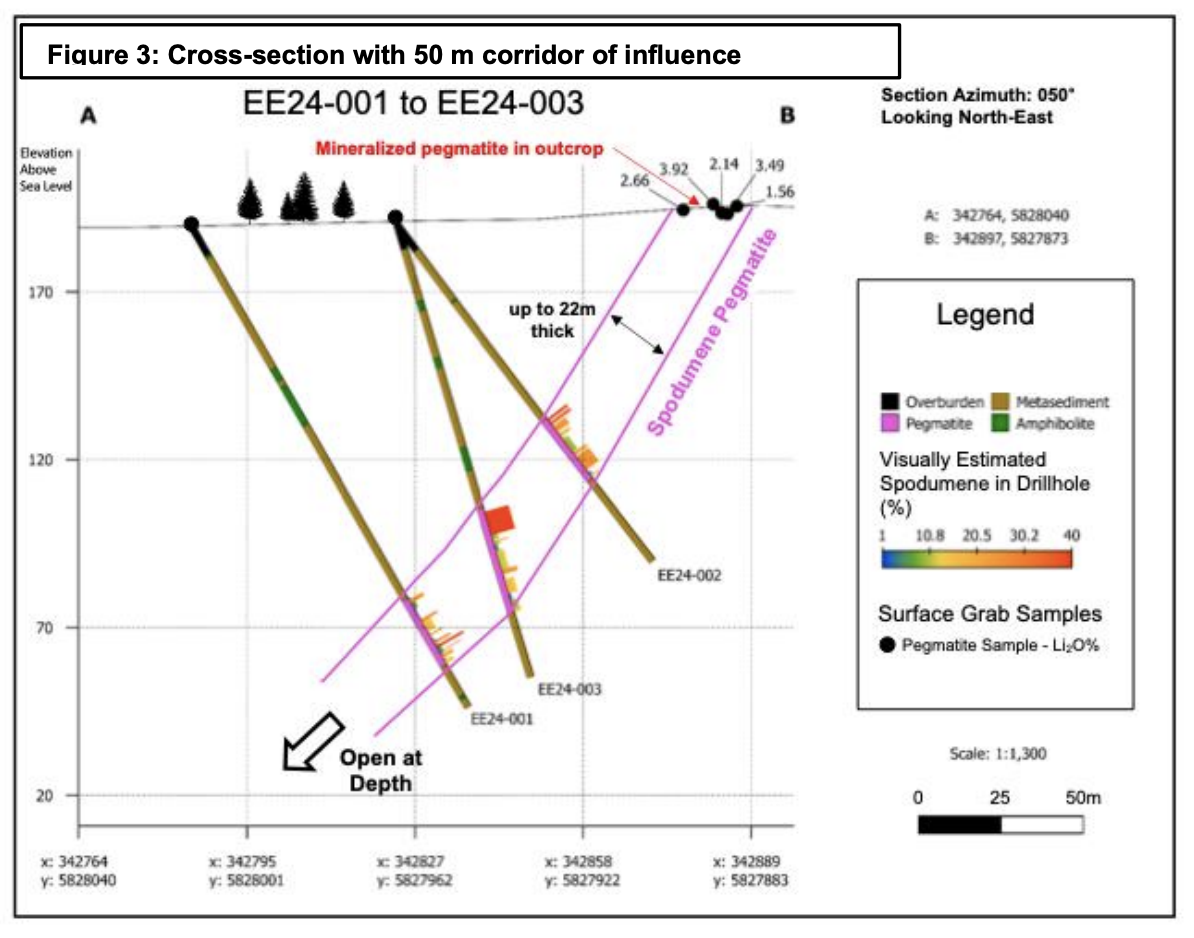

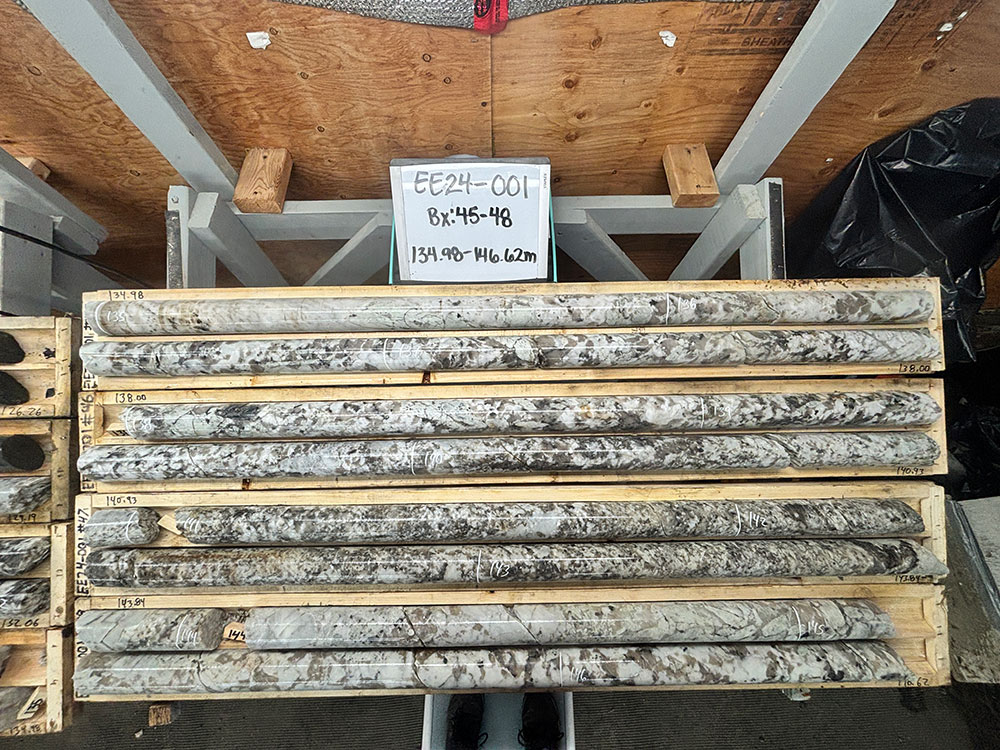

- November 26, 2024 Quebec Precious Metals Reports Consistent +20m Thick Spodumene-Bearing Pegmatite Up to 150m Deep from its Maiden Drilling Program on its 100%-owned Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- November 07, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- October 31, 2024 The Cree Hunters Economic Security Board, 16 Mining & Exploration Companies Contribute $750,000 For The Reconstruction Initiative Forest Fires Fund 2023, James Bay, Quebec

- October 30, 2024 Quebec Precious Metals Intersects 22.9 m of Spodumene-Bearing Pegmatite in the First Drillhole of its Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- October 21, 2024 Quebec Precious Metals Begins Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, Situated Near the Galaxy Project to be Acquired by Rio Tinto, James Bay, Quebec, Announces Private Placement

- September 19, 2024 Quebec Precious Metals Congratulates Harfang Exploration on its High-Grade Gold Discoveries near the Sakami Project and Provides Update on Gold and Lithium Exploration Initiatives in James Bay

- August 09, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- July 17, 2024 Quebec Precious Metals Announces Results of Annual Shareholders Meeting, Grants Deferred Share Units and Stock Options