Download PDF | View documents on Sedar

HIGHLIGHTS

- Vital to acquire Quebec Precious Metals Corporation’s 68% interest in Kipawa Rare Earth project and 100% of Zeus Rare Earth project in Quebec, Canada, for C$8 million (~A$8.5 million)

- Kipawa and Zeus are heavy rare earth projects which complement Vital’s light rare earths operations at Nechalacho

- Acquisition has potential to transform Vital into the only producer of both light and heavy rare earths in North America

- The Kipawa Project was previously held in a Joint Venture with Toyotsu Rare Earth Canada, Inc. (“Toyotsu”), which included off-take provisions. Toyotsu’s interest was converted into a 10% Net Profit Interest (“NPI”).

- NI 43-101 defined Mineral Resource Estimate as well as Proven and Probable Reserve Estimate on the Kipawa Project

- Vital plans to update the 2013 Definitive Feasibility Study completed for Kipawa project

- Vital intends to duplicate the strong Indigenous and community employment and procurement model that it has demonstrated at its Nechalacho REE mine in the NWT

Vital Metals Limited (ASX: VML) (“VML”, “Vital”, “Vital Metals” or “the Company”) and Quebec Precious Metals Corporation (TSX.V: QPM, OTCQB: CJCFF, FSE: YXEP) (“QPM”) are pleased to announce that they have signed a binding term sheet (the “Term Sheet”) for the acquisition by VML of QPM’s 68% interest in the Kipawa exploration project and 100% interest in the Zeus exploration project (the “Projects”). Joint Venture partner Investissement Québec (“IQ”) holds the remaining 32% of the Kipawa project.

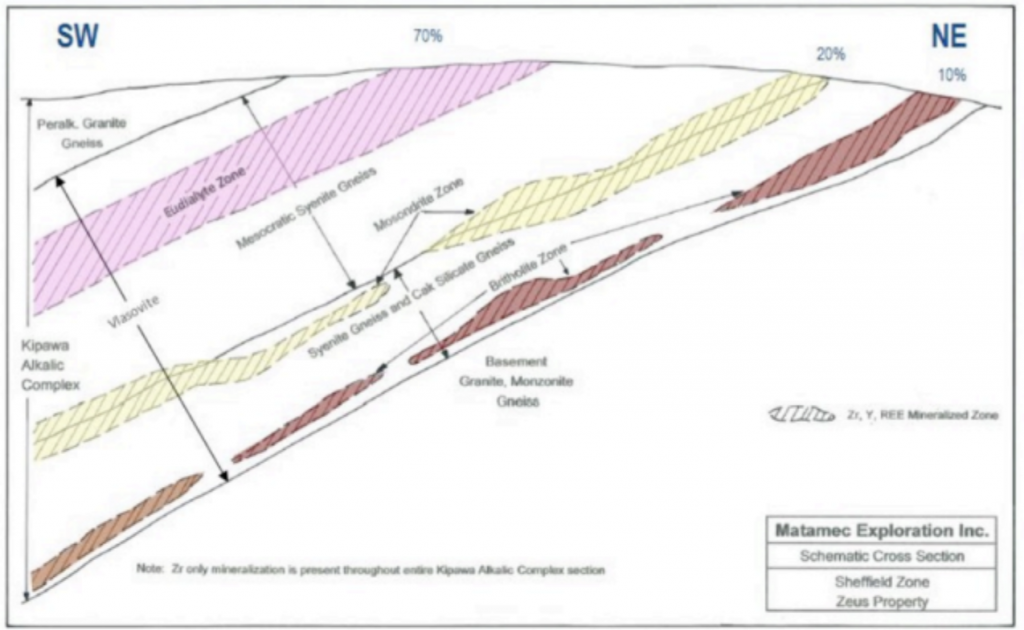

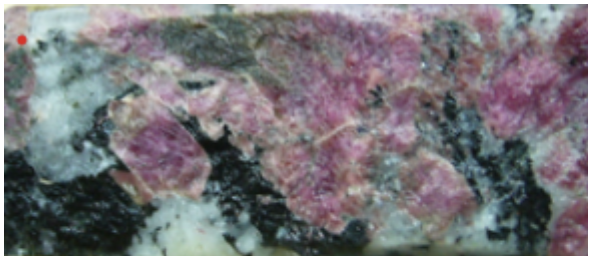

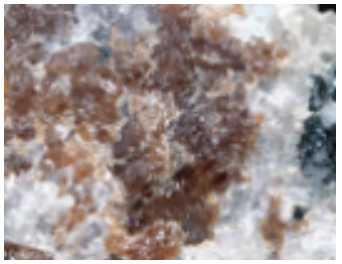

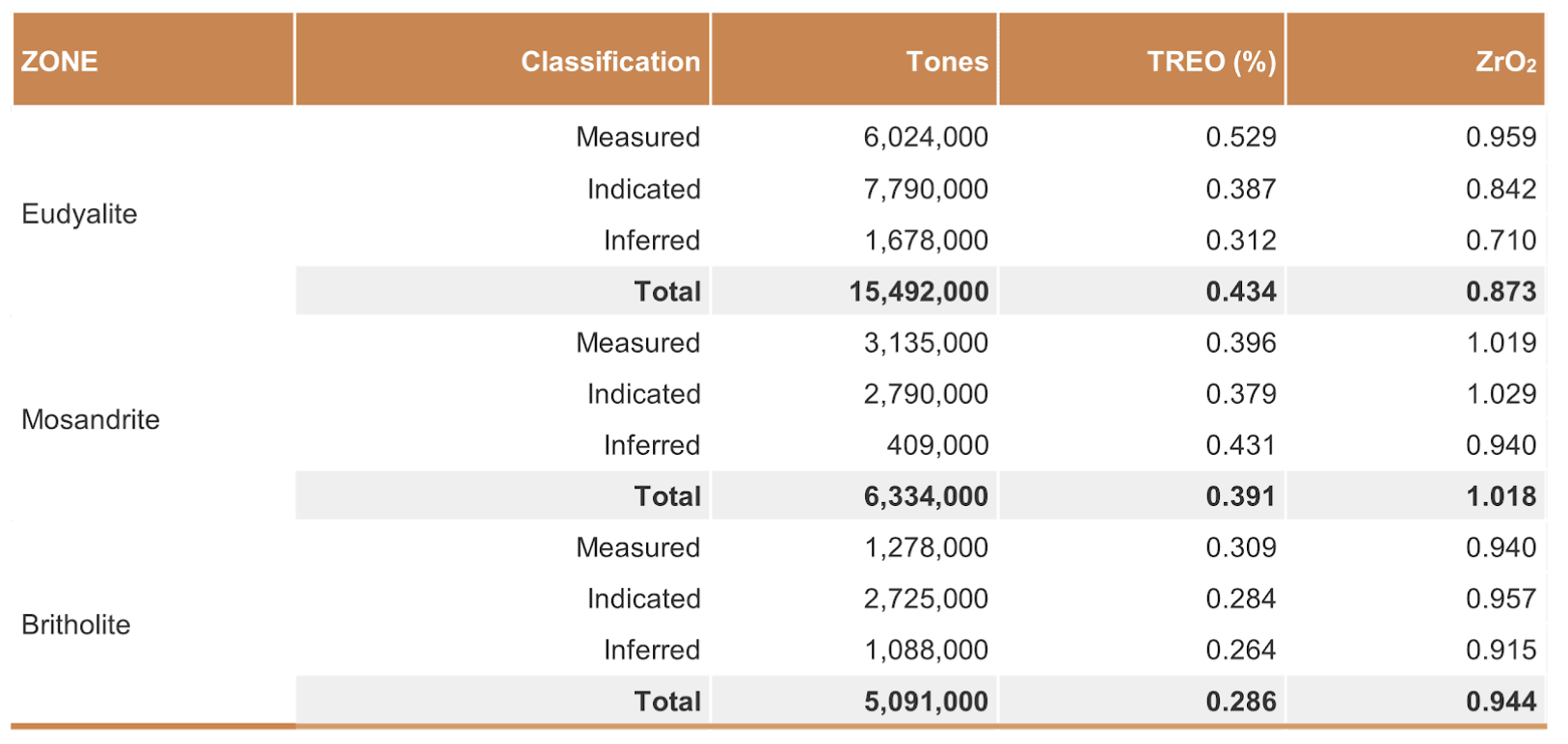

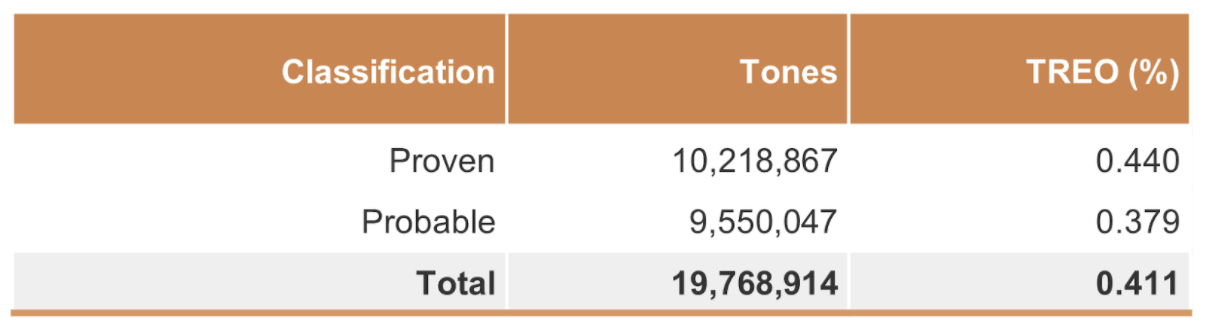

Kipawa is a heavy rare earths project, located 50km from Temiscaming in Quebec, with a Mineral Resource Estimate of 15.5Mt of eudyalite at 0.434% TREO and 0.873 ZrO2, 6.3Mt of mosandrite at 0.391% TREO, 1.018% ZrO2, 5.1Mt of britholite at 0.286% TREO, 0.944% ZrO2, and with a Proven and Probable Reserve Estimate of 19.8Mt at 0.411% TREO.

Investors should note that the terms “Mineral Resource”, “Mineral Reserve” and, “Proven and Probable Reserve” are as defined by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) as the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM council. These estimates are foreign estimates and are not reported in accordance with the Joint Ore Reserves Committee’s Australasian Code for Reporting of Mineral Resources and Ore Reserves (the “JORC Code”). A competent person has not done sufficient work to classify these estimates as a mineral resource or ore reserve in accordance with the JORC Code and it is uncertain that following further exploration or evaluation work that the foreign estimates will be able to be reported as a mineral resource or ore reserves in accordance with the JORC Code.

QPM’s Chief Executive Officer Normand Champigny stated: “We are pleased with the acquisition by Vital Metals of the Projects. We have been successful in our monetization of our non-core assets since the creation of QPM in 2018.”

Projects Overview

The Projects total 73 claims over 43km2 and lie in the Grenville geological province, approximately 55km south of the geological contact with the Superior geological province. The lithologies consist mainly of gneiss with a grade of metamorphism ranging from the greenschist facies to the amphibolite-granulite facies.

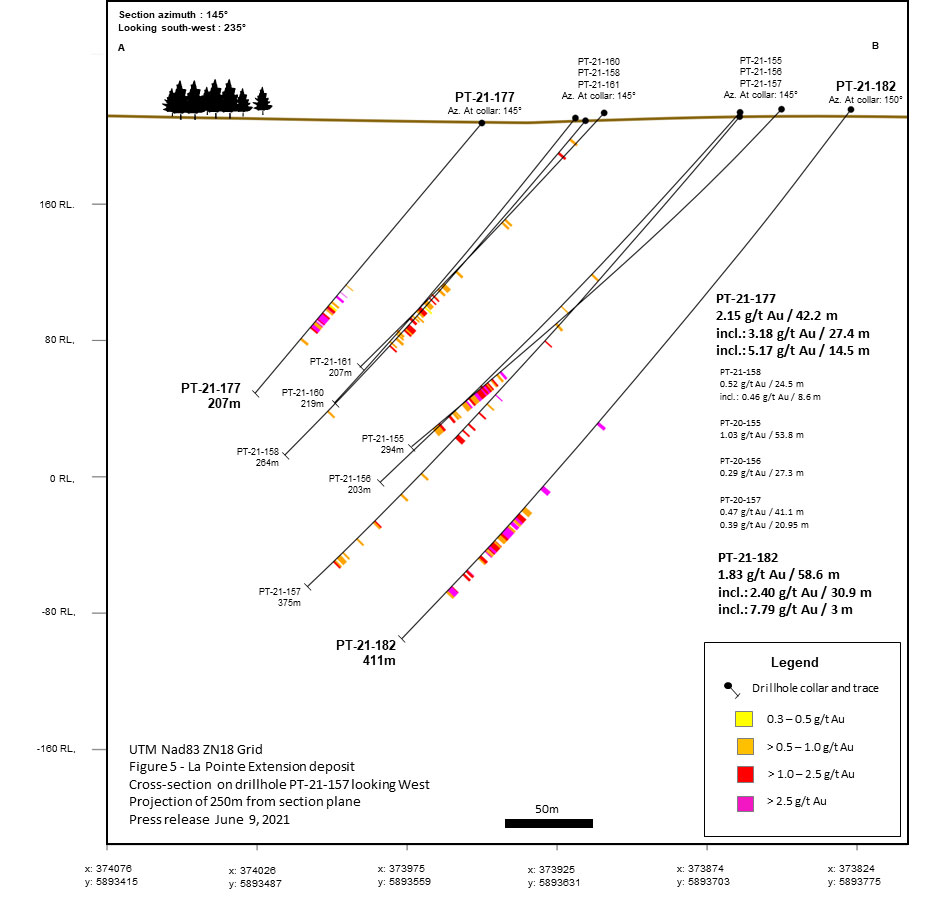

The Kipawa deposit is defined by three enriched horizons within the “Syenite Complex”, which contains some light rare earth oxides but primarily heavy rare earth oxides. Drilling since 2011 totals 293 drill holes (24,571m) and was used to prepare a feasibility study which was completed by Matamec Explorations Inc. in 2013.

Twelve heavy rare earth showings have been identified on the Zeus project, some of which contain niobium and tantalum.

Source of HREE and Zr

Source of HREE

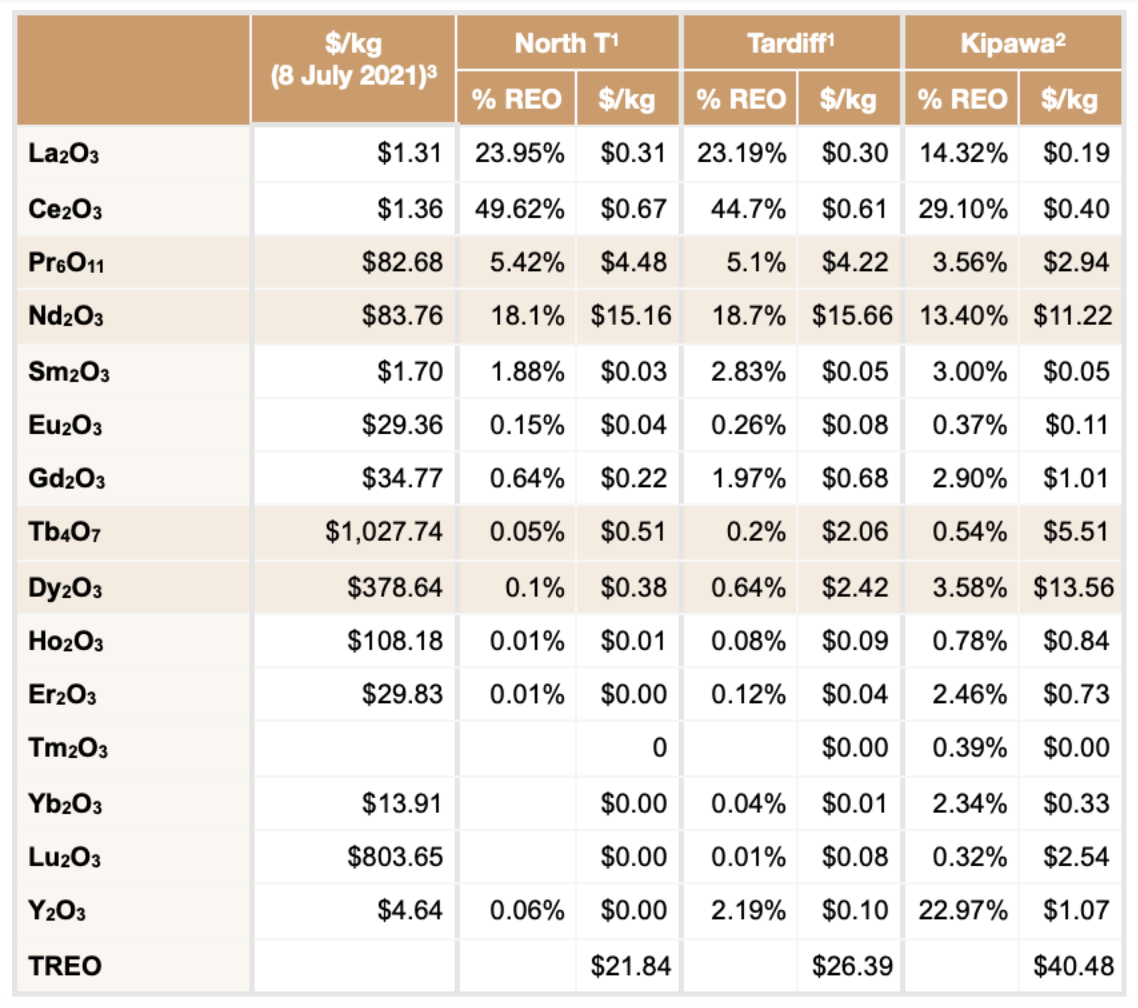

Table 1: Rare Earth Oxide distribution at Current Prices

1Rare earth distribution of North T and Tardiff zones as determined under the Vital’s 2012 JORC Report (refer 15 April 2020) and as detailed in announcement 2nd February 2021.

2 Rare earth distribution of Kipawa 2013 Feasibility Study (refer https://www.qpmcorp.ca/en/projects/kipawa/)

3 Rare earth prices sourced from Shanghai Metals Market (www.metal.com) as at 8 July 2021

Term Sheet Conditions

The Term Sheet contemplates the acquisition by VML of a 68% legal and beneficial interest in the Kipawa project, and all of QPM’s rights, title and interest in the Joint Venture Agreement with IQ, and 100% legal and beneficial interest in Zeus project. Key terms of the Term Sheet are as follows:

- QPM agrees to sell to VML or an affiliate of VML (the “Purchaser”) the Projects for a total purchase price of C$8m payable as follows:

- C$150,000 deposit on signing the Term Sheet;

- C$2.35m on acquisition of the Projects;

- C$2.5m on the first anniversary of acquisition;

- C$1m on the second anniversary of acquisition;

- C$1m on the third anniversary of acquisition; and

- C$1m on the fourth anniversary of acquisition.

Purchaser will grant security over the Projects to QPM until the consideration is paid in full.

- Acquisition of the interests in the Projects is to occur at the completion of the sale and purchase by Purchaser when all conditions precedent have been satisfied or waived.

- Following the execution of the Term Sheet on August 9 (the “Execution Date”), VML shall conduct due diligence within one of the following periods, whichever is applicable:

- 3 months following the Execution Date, provided that VML’s nominated personnel visit the Projects within a period of 2 months following the Execution Date; or

- In the event VML’s nominated personnel are unable to visit the Projects within a period of 2 months following the Execution Date, on the earlier of: (i) 1 month following the date of arrival of VML’s nominated personnel on either the Kipawa and Zeus Projects, and (ii) 6 months following the Execution Date.

- Conditions precedent include:

- VML due diligence;

- QPM shall have delivered to VML executed releases as to the discharge of all encumbrances over the Projects, other than permitted encumbrances;

- VML shall have obtained from the ASX confirmation that ASX Listing Rule 11.1.3 does not apply to the transactions as contemplated by this term sheet, and if ASX determine that ASX Listing Rule 11.1.2 applies to the transactions, the shareholders of VML approving the transactions for the purposes of ASX Listing Rule 11.1.2. ASX has confirmed that neither Listing Rule 11.1.3 or Listing Rule 11.1.2 apply to this transaction;

- QPM shall have delivered to VML all consents or agreements required to assign the existing royalties (being the 10% NPI with Toyotsu Rare Earth Canada, Inc.) from QPM to VML and as required to grant the security over the Projects to QPM;

- In respect of the joint venture agreement (“JV Agreement”) with IQ:

- IQ shall have waived its right of first refusal under the JV Agreement;

- IQ shall have consented to the sale of QPM’s rights and interests in the Kipawa project and the JV Agreement to VML; and

- VML shall have delivered to IQ a written notice in accordance with the

JV Agreement accepting to be bound by the terms and conditions of the JV Agreement.

- Other customary conditions of closing, including various third-party approvals.

The Term Sheet contains other terms and conditions considered standard for an agreement of its nature including representations and warranties given by the parties.

Consideration will be paid from VML’s existing cash reserves. Dependent upon access for due diligence as set out above, the acquisition will complete before 28 February 2022.

QPM will provide more updates on the planned acquisition as it progresses.

Qualified/Competent Persons Statement

Information and statement relating to the Mineral Resource Estimate for the Kipawa Rare Earth Project is based on, and fairly represents, information and supporting documentation prepared by Matamec Explorations Inc. and the “Qualified Person” under NI 43-101 is Mr Yann Camus, Eng from SGS Canada Inc. The data in this press release has been reviewed by Mr Brendan Shand. Mr Shand is a Competent Person and a member of the Australasian Institute of Mining and Metallurgy and an employee of the Company. Mr Shand has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Shand confirms that the information is an accurate representation of the available data and studies including the Technical Report and Resource estimation obtained from a NI43-101 Compliant Feasibility Study for the Kipawa Project submitted by Matamec Explorations Inc (Effective Date: September 3, 2013, Issue Date: October 17, 2013).

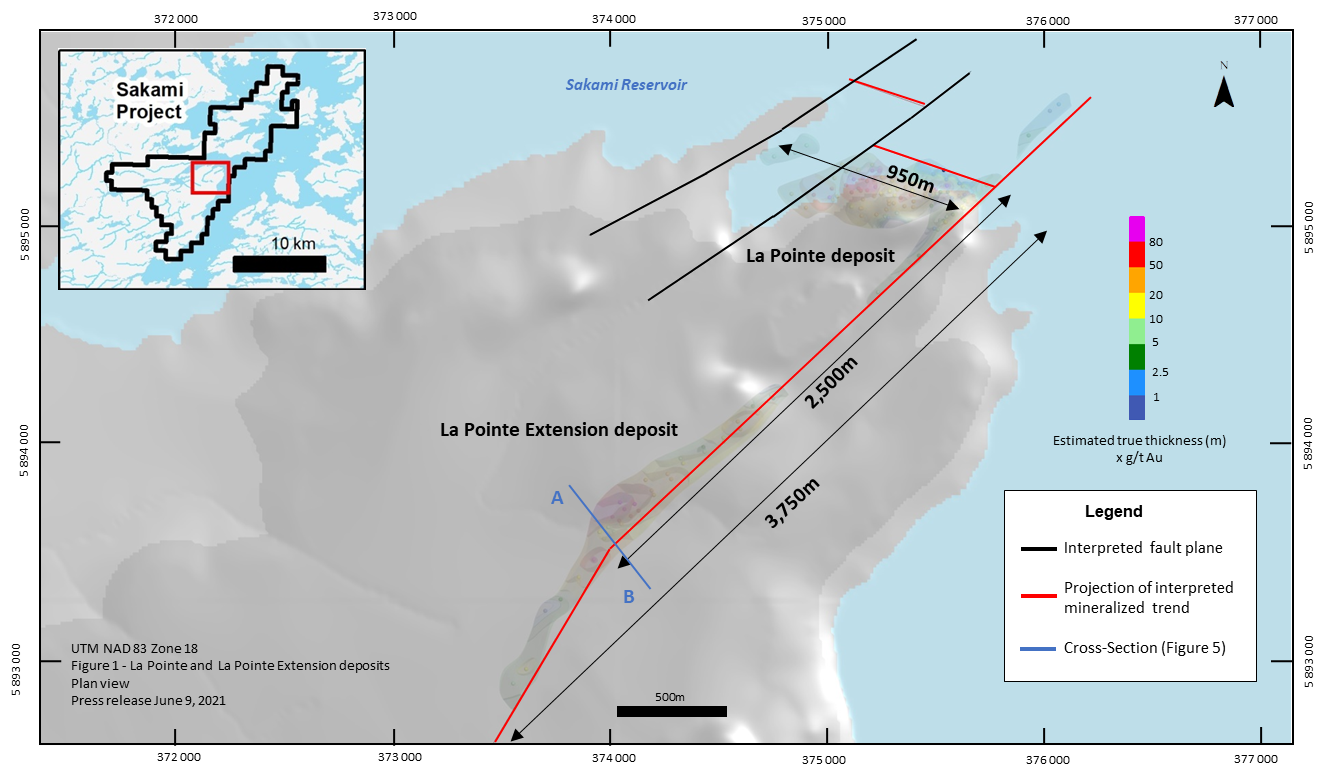

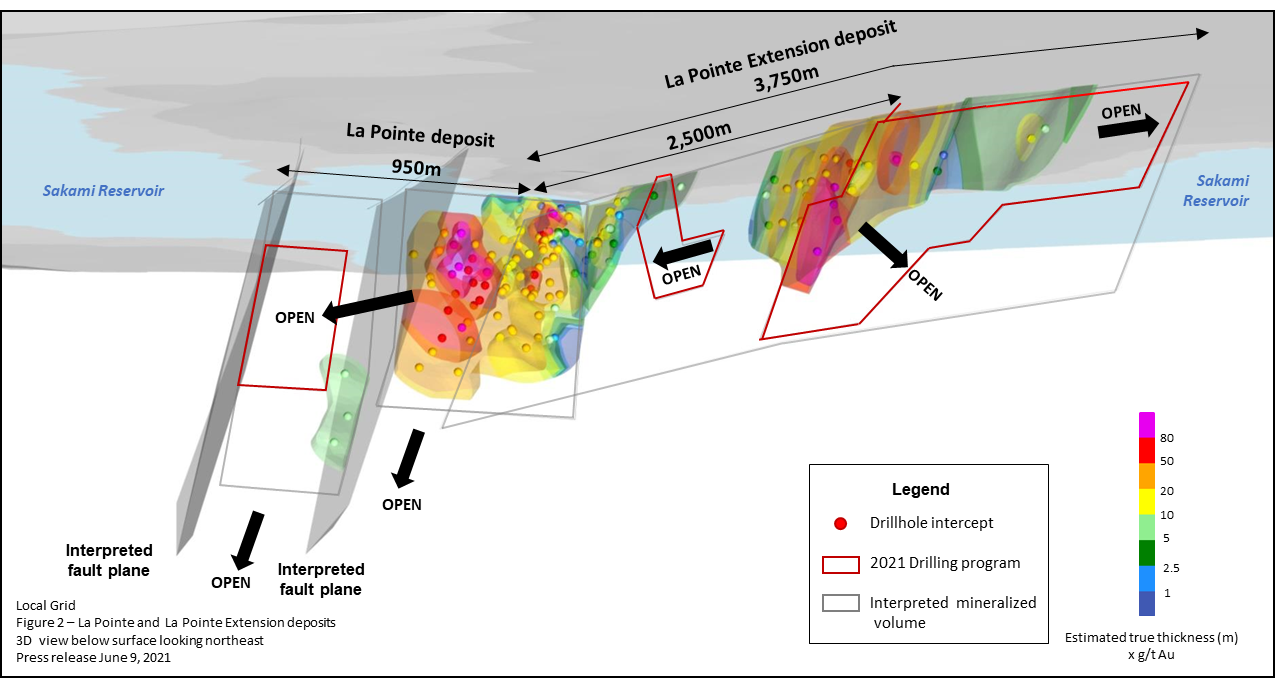

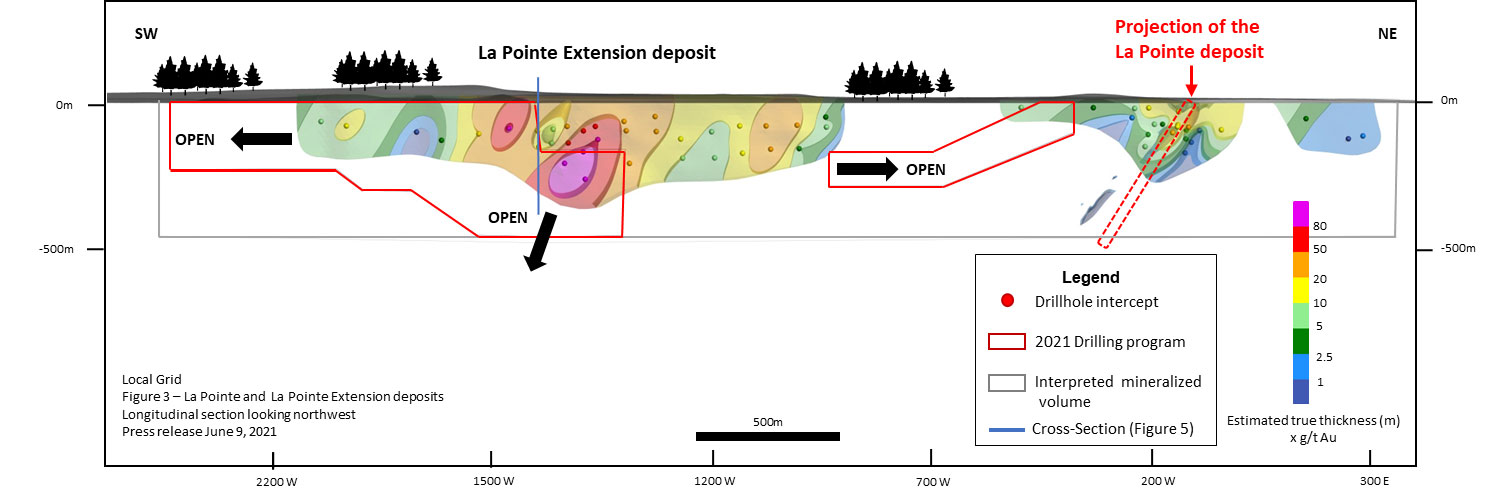

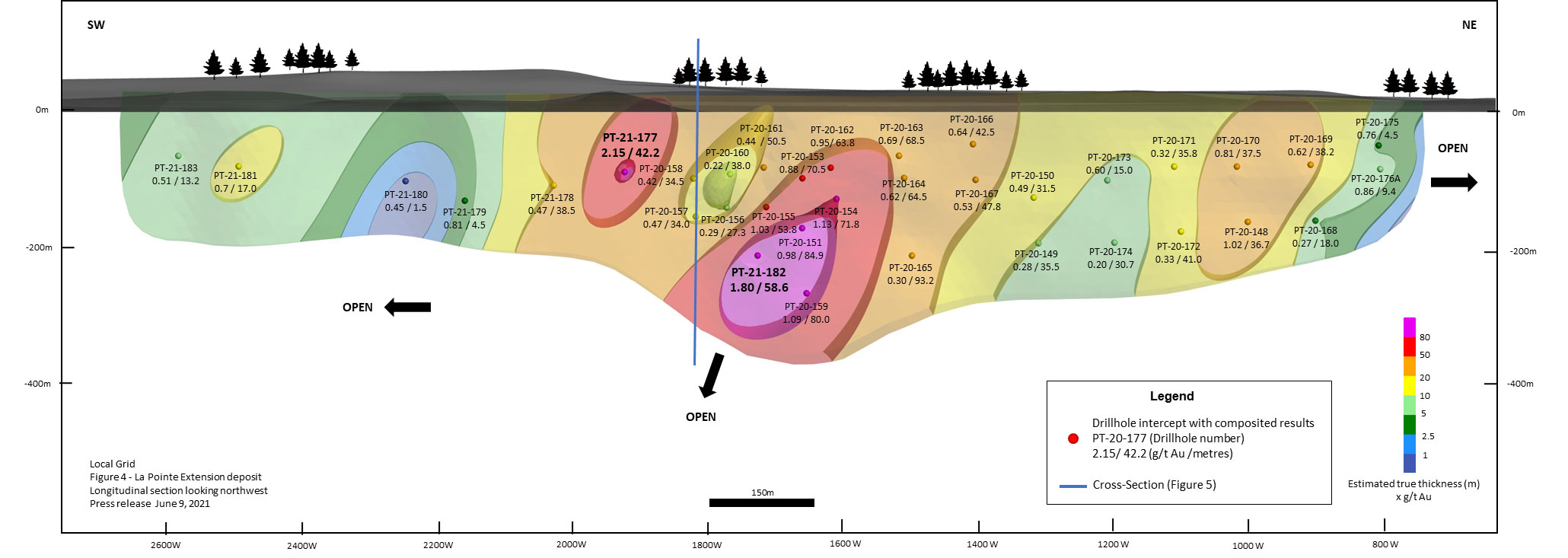

Sakami Project Technical Report

Following a letter of observation sent by the Autorité des marchés financiers on July 26, 2021, QPM filed on SEDAR an amended version of the previously disclosed technical report dated April 21, 2021 and entitled “NI 43-101 Technical Report for the Sakami Project, Eeyou Istchee James Bay territory, Quebec, Canada”. The amended report does not contain any material changes.

– ENDS-

Contacts: |

| Mr Geoff Atkins Managing Director Vital Metals Limited Phone: +61 2 8823 3100 Email: vital@vitalmetals.com.au |

Mr Jean-François Meilleur

President

Quebec Precious Metals Corporation

Phone: +1 514 951 2730

Email: jfmeilleur@qpmcorp.ca

Mr Normand Champigny

Chief Executive Officer

Quebec Precious Metals Corporation

Phone: +1-514 979 4746

Email: nchampigny@qpmcorp.ca

This announcement has been authorised for release by the Board of directors of QPM.

ABOUT QUEBEC PRECIOUS METALS CORPORATION

QPM is a gold explorer with a large land position in the highly-prospective Eeyou Istchee James Bay territory, Quebec, near Newmont Corporation’s Éléonore gold mine. QPM’s flagship project is the Sakami project with significant grades and well-defined drill-ready targets. QPM’s goal is to rapidly explore the project to advance it to the mineral resource estimate stage.

QPM Forward-Looking Statements

This release includes forward-looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production output.

Forward-looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause QPM’s actual results, performance and achievements to differ materially from any future results, performance or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of resources or reserves, political and social risks, changes to the regulatory framework within which QPM operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward-looking statements are based on QPM’s and its management’s good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect QPM’s business and operations in the future. QPM does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the QPM’s business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by QPM or management or beyond the QPM’s control.

Although QPM attempts to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward-looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be anticipated, estimated or intended, and many events are beyond the reasonable control of QPM. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements in this release are given as at the date of issue only. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information, QPM does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based.

ABOUT VITAL

Vital Metals Limited (ASX: VML) is Canada’s rare earths producer following commencement of operations at its Nechalacho rare earths project in Canada in June 2021. It holds a portfolio of rare earths, technology metals and gold projects located in Canada, Africa and Germany.

Nechalacho Rare Earth Project – Canada

The Nechalacho project is a high grade, light rare earth (bastnaesite) project located at Nechalacho in the Northwest Territories of Canada and has potential for a start-up operation exploiting high-grade, easily accessible near surface mineralisation. The Nechalacho Rare Earth Project hosts within the Upper Zone, a JORC Resource of 94.7MT at 1.46% TREO comprised of a Measured Resource of 2.9MT at 1.47% TREO, an Indicated Resource of 14.7MT at 1.5% TREO, and an Inferred Resource of 77.1MT at 1.46% TREO.

Compliance Statements

This announcement contains information relating to Mineral Resource Estimates in respect of the Nechalacho Project extracted from ASX market announcements reported previously and published on the ASX platform on 13 December 2019 and 15 April 2020. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcements and that all material assumptions and technical parameters underpinning the estimates in the original market announcements continue to apply and have not materially changed.

Vital Forward-Looking Statements

This release includes forward-looking statements. Often, but not always, forward-looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production output.

Forward-looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to differ materially from any future results, performance or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of resources or reserves, political and social risks, changes to the regulatory framework within which the entity operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward-looking statements are based on the entity and its management’s good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. There are no assurances that the assumptions on which forward looking statements are based will prove to be correct, or that the Company’s business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the entity’s or management or beyond the Company’s control.

Although there have been attempts to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward-looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be anticipated, estimated or intended, and many events are beyond the reasonable control of the entity. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements in this release are given as at the date of issue only. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information, the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based.

Listing Rule 5.12 Foreign Resource Estimate information

The information in this announcement relating to the Mineral Resource Estimate and Ore Reserves for the Kipawa Project is reported in accordance with the requirements applying to foreign estimates in the ASX Listing Rules (the “Foreign Estimates”) and, as such are not reported in accordance with the 2012 edition of the JORC Code. As such, the following information is provided in accordance with ASX Listing Rules 5.10 & 5.12:

- The source and date of the foreign estimate (LR 5.12.1)

The source of the foreign estimate is taken from public documents released by Matamec Explorations Inc. on October 21, 2013. Further information on these releases may be found on SEDAR website (www.sedar.com).

- Whether the foreign estimates use categories of mineralisation other than those defined in JORC Code 2012 and if so, an explanation of the differences (LR 5.12.2)

Categories described are the same as those defined in JORC Code 2012, whereby resources were classified as Inferred, Indicated or Measured

- The relevance and materiality of the foreign estimates to the entity (LR 5.12.3)

VML considers the foreign estimates to be both material and relevant to the Kipawa project as it provides an indication of the size and scale of the project.

- The reliability of the foreign estimates, including reference to any criteria in Table 1 of JORC Code 2012 which are relevant to understanding of the reliability of the foreign estimates (LR 5.12.4)

It is the opinion of VML that these estimates are reliable and represent the results of work done to very high standards, using high quality sampling, testing and geological and geostatistical modelling. The foreign estimates represent best practice work at the time.

- To the extent known, a summary of the work programs on which the foreign estimates are based and a summary of the key assumptions, mining and processing parameters and methods used to prepare foreign estimates (LR 5.12.5)

The Technical Report includes key assumptions for commodity prices, mining and processing costs, and there has been no material changes in assumptions. The Technical Report in its current form is considered to be a comprehensive compilation of all available data applicable to the estimation of mineral resources. A summary of key assumptions and methods used to prepare the Foreign Estimate include:

- The resource is reported according to CIM Definition Standards (2010)

- By using SGS Geostat model, the mineral reserve for the Feasibility Study was prepared, estimated and supervised by Roche using a cut-off value of $48.96/t with 5% dilution and a mining recovery of 95.2%. The Kipawa open-pit design utilized a marginal (or milling) cut-off value of $48.96/t and a break-even cutoff value of $60.70/t. Included in the reserves are 632,000 tonnes of low-grade material lying between these 2 cut-off values. This material will be sent on a low-grade stockpile, close to the mine site, and will be processed at the end of the operation after mine depletion.

- The Foreign Estimate and current Technical Report is based on a total of 293 drill holes totalling 24,571m and 13 trenches totalling 631m. Historical Unocal holes are not in the count and were not used for the estimates. The mineralised zones were interpreted on vertical sections and meshed into volumes as per industry standard. Ordinary kriging was used to estimate the block model with block size set at 10m x 5m x 5m. The measured and indicated resources required drill grids 25m and 50m respectively. Resources extrapolated beyond 30m of those drill grids are considered inferred.

- Any more recent estimates or data relevant to the reported mineralisation available to the entity (LR 5.12.6)

No further resource estimates or data relevant to the resource estimation are available.

- The evaluation and/or exploration work that needs to be completed to verify the foreign estimates as mineral resources or reserves in accordance with JORC Code 2012 (LR 5.12.7)

A revision of the historical drilling information will be completed, to further ensure the integrity of the data, followed by another estimation of the resource, with updated classification based on the level of information available. In addition, VML intends to conduct further drilling, bulk sampling, geotechnical and hydrological testing.

- The proposed timing of any evaluation and/or exploration work that the entity intends to undertake and a comment on how the entity intends to fund that work (LR 5.12.8)

VML intends to conduct drilling, bulk sampling, geotechnical and hydrological testing and will embark on this work as access permits are granted and intend to complete this work within several months. The work will be funded from existing working capital.

- April 28, 2025 Fury Gold Mines Completes Acquisition Of Quebec Precious Metals Corporation

- April 22, 2025 Quebec Precious Metals Announces Shareholder Approval of Arrangement with Fury Gold

- April 09, 2025 The Cree Trappers Association, the Cree Hunters Economic Security Board and Mining & Exploration Companies Approve 2025 Funding to Continue the Reconstruction of Cabins Burnt during the 2023 Forest Fires, James Bay, Quebec

- March 26, 2025 Fury Gold Mines and Quebec Precious Metals Update Merger Process

- February 26, 2025 Fury Gold Mines Limited to Acquire Quebec Precious Metals Corporation

- January 17, 2025 Quebec Precious Metals Receives Payment of $200,000 from the Sale of Non-Core Asset in Ontario

- November 26, 2024 Quebec Precious Metals Reports Consistent +20m Thick Spodumene-Bearing Pegmatite Up to 150m Deep from its Maiden Drilling Program on its 100%-owned Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- November 07, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- October 31, 2024 The Cree Hunters Economic Security Board, 16 Mining & Exploration Companies Contribute $750,000 For The Reconstruction Initiative Forest Fires Fund 2023, James Bay, Quebec

- October 30, 2024 Quebec Precious Metals Intersects 22.9 m of Spodumene-Bearing Pegmatite in the First Drillhole of its Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- October 21, 2024 Quebec Precious Metals Begins Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, Situated Near the Galaxy Project to be Acquired by Rio Tinto, James Bay, Quebec, Announces Private Placement

- September 19, 2024 Quebec Precious Metals Congratulates Harfang Exploration on its High-Grade Gold Discoveries near the Sakami Project and Provides Update on Gold and Lithium Exploration Initiatives in James Bay

- August 09, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- July 17, 2024 Quebec Precious Metals Announces Results of Annual Shareholders Meeting, Grants Deferred Share Units and Stock Options