Download PDF | View documents on Sedar

- High priority target areas totalling 125 km2 identified with pegmatite rocks on all projects;

- Follow-up field program in September to sample pegmatites

- Increased exposure to lithium through existing ownership of 12 million shares of Champion Electric Metals Inc.

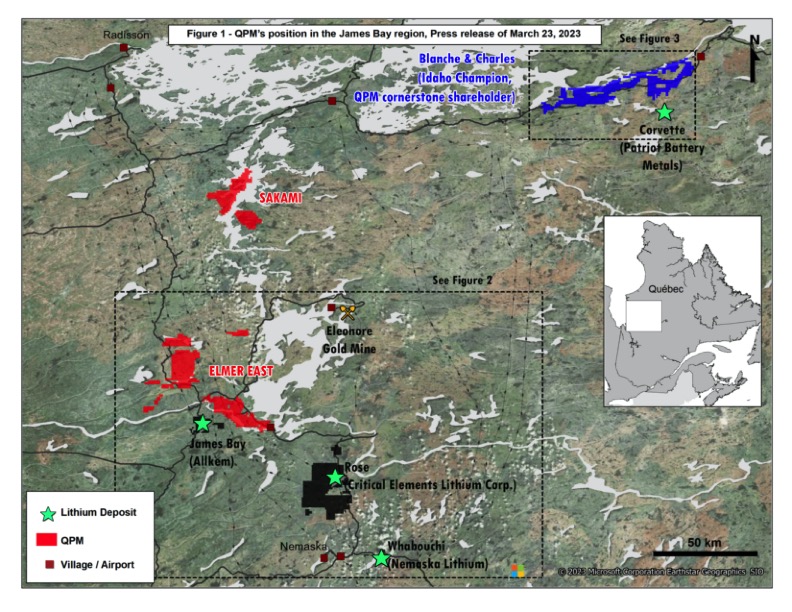

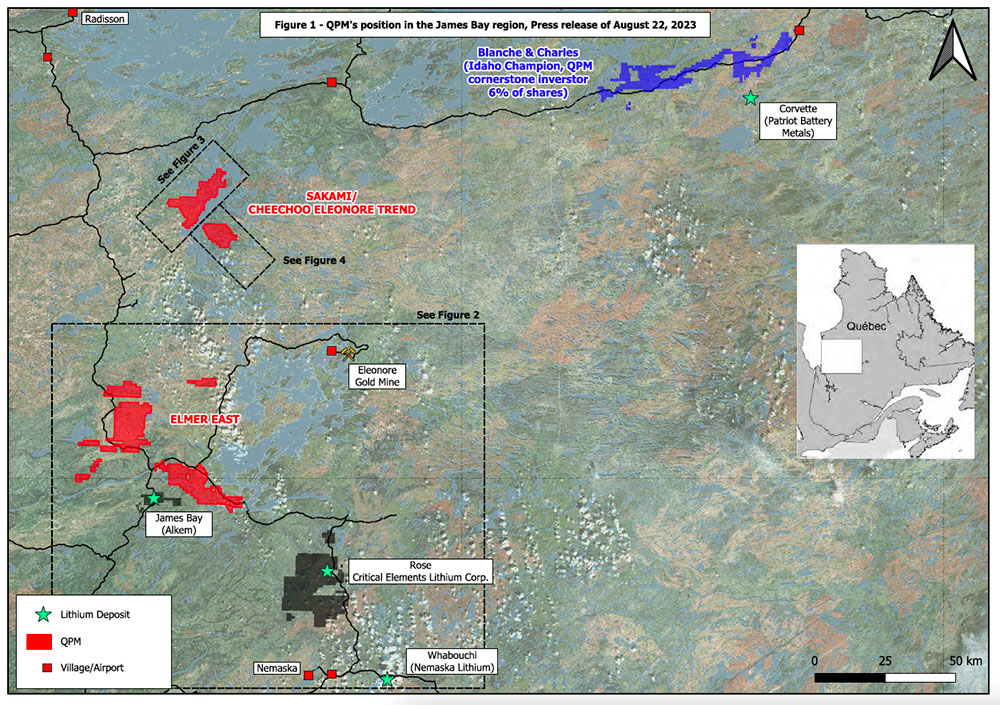

Montreal, August 22, 2023 – Quebec Precious Metals Corporation (TSX.V: QPM, FSE: YXEP, OTC-BB: CJCFF) (“QPM” or the “Corporation”) is pleased to announce that high priority lithium targets have been identified following a detailed lithium targeting study (the “Study”) on all of its exploration projects (1,298 claims covering 676 km2, 100% owned) performed by ALS GoldSpot Discoveries Ltd. (“ALS GoldSpot”), located in the Eeyou Istchee James Bay territory in Quebec. Figure 1 illustrates QPM’s land position and the location of high priority targets for the three projects based on the findings of the Study.

“We are very excited to sample the target areas to further demonstrate the lithium potential of our projects in a district that has some of the largest spodumene pegmatite resources in the world. All our projects are highly prospective for lithium and are located near advanced projects and recent significant lithium discoveries” commented Normand Champigny, CEO.

The Study began in the spring (see press release of March 27, 2023). Target generation was undertaken by an exhaustive compilation, extraction and integration of geochemical, geophysical and geological data using geoscience expertise coupled with ALS GoldSpot’s proprietary data analytics workflows. The high priority targets were generated using a total of 52,289 rock samples and 8,278 sediment (soil and till) samples. The data compilation stems from over 150 technical reports using artificial intelligence to query relevant geochemical and geological signatures of lithium bearing formations. The analysis resulted in the generation of detailed maps showing targets, zones and areas of focus for further exploration. The Study is being supplemented by the acquisition and analysis of high resolution imagery and topography.

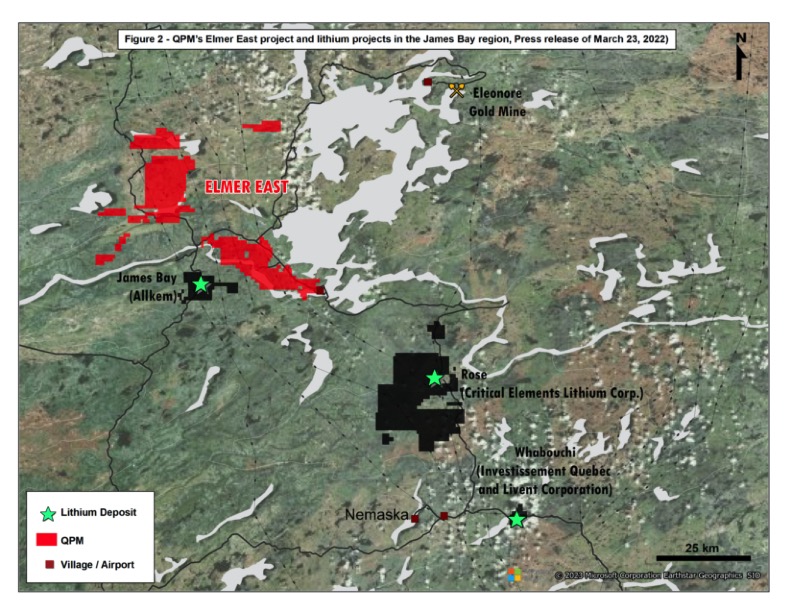

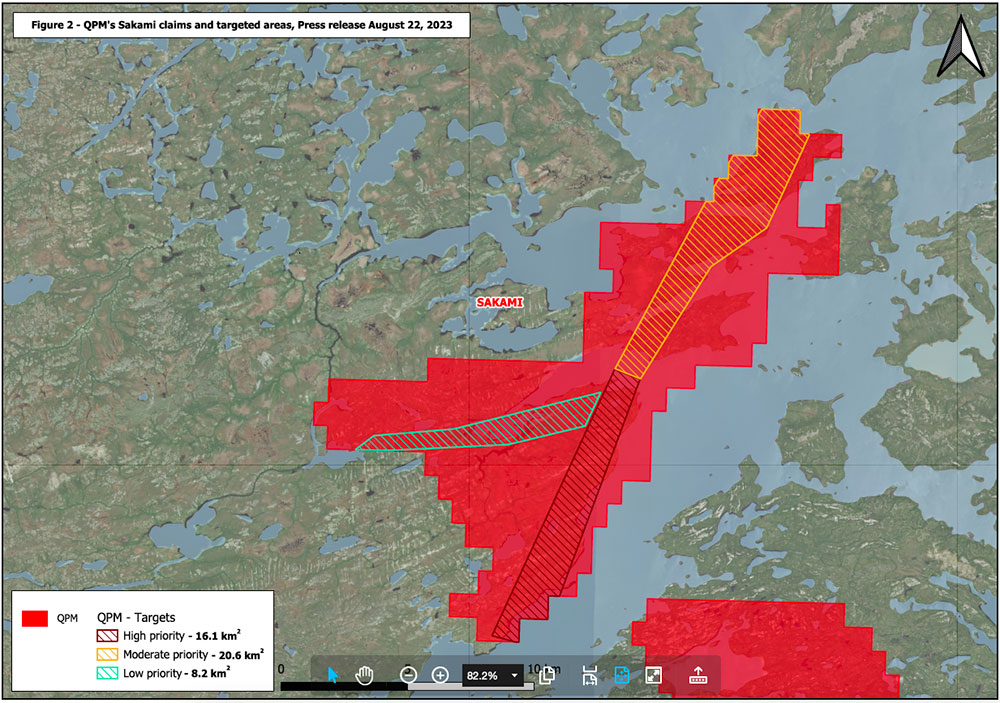

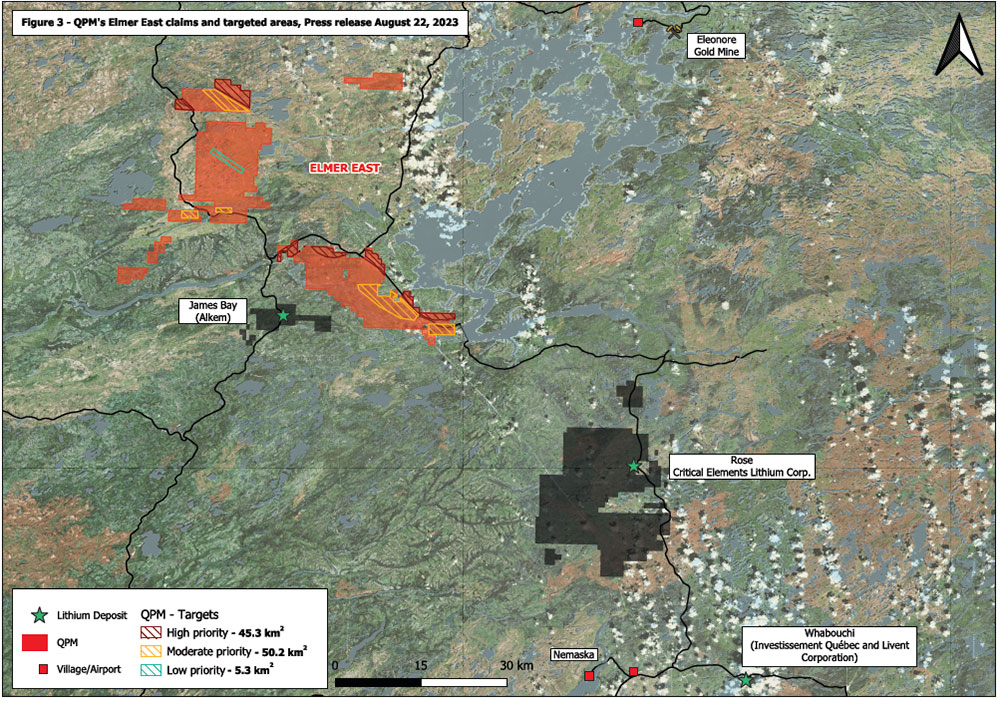

Sakami project (281 claims, 143 km2, 16 km2 high priority) and Elmer East project (889 claims, 467 km2, 45 km2 high priority) – The Sakami project is hosted within a volcano-sedimentary sequence of the Yasinski Group, which is metamorphosed to amphibolite facies and is strongly deformed by a regional west-southwest to east-northeast event in contact with sedimentary rocks of the Laguiche Group (Opinaca geological Subprovince) to the east (Figure 3). The Elmer East project consists of different parts of the Eastmain volcano-sedimentary belt. Two of the Elmer East claim blocks are located on the eastern edge of the Duxbury batholith and are composed of the Bernou and Pilipas formations (Figure 2).

For both projects, key mineral indicators and rock geochemistry highlight Li-Cs-Ta pegmatite anomalies and a favorable distinct felsic intrusion trend. Major ductile structures bordering volcanosedimentary domains control the distribution of Li-Cs-Ta mineralization. Li-Cs-Ta indicators are associated with known lithium deposits in the region. Small felsic intrusions proximal to the structures are also of interest. It is to be noted that for the Sakami project the lithium targets identified have sometimes overlapping potential for the discovery of both lithium-bearing pegmatites and gold mineralization. Approximately 10 km southwest of the Elmer East project, Brunswick Exploration Inc. recently disclosed lithium discovered through inaugural drilling at their Anatacau West project.

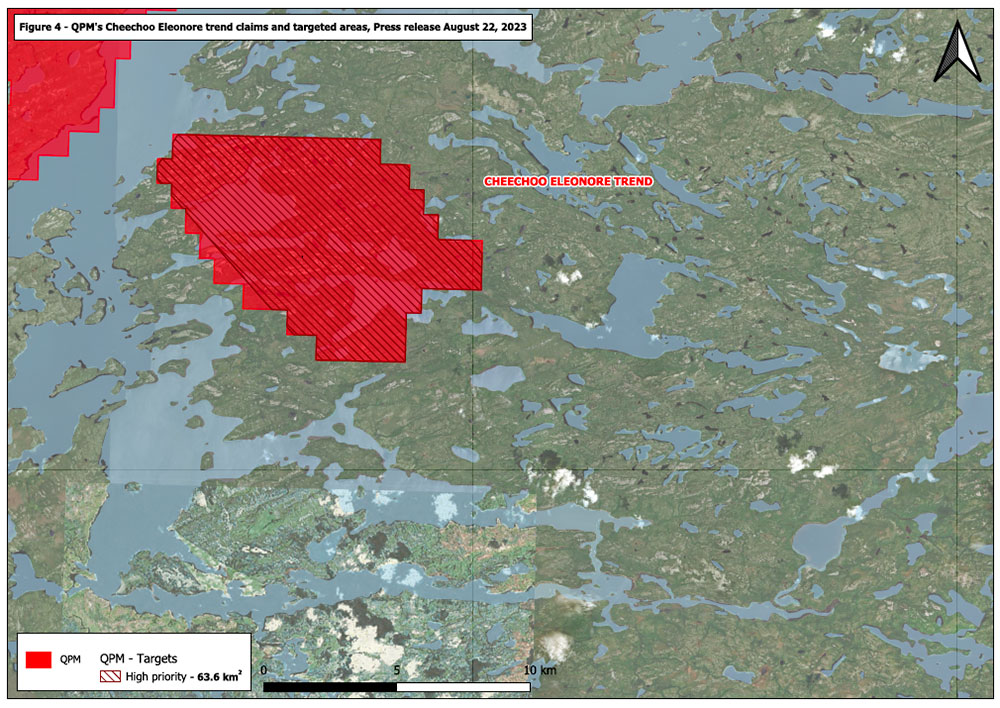

Cheechoo-Eleonore Trend project (128 claims, 66 km2, 64 km2 high priority) – Two main lithologic assemblages, are present: metasediments of the Laguiche complex and intrusive rocks associated with the granitic suite of the Vieux Comptoir. The latter is essentially formed of a series of granitic intrusions more or less rich in alkaline feldspar and generally poor in mafic minerals. Spodumene and K-feldspar granites have been observed. The abundance of pegmatites and geochemical anomalies suggest a strong lithium potential (Figure 4).

Follow-up field program

The access and travel restrictions imposed by the Government of Quebec in response to the unprecedented forest fire situation persisting since early June remain in place across a significant part of the region. The Company will be mobilizing in September field personnel to visit the high priority target areas and conduct surface sampling. Results are expected in the fall. All pegmatite samples will be assayed with the analytical method ME-MS89L (+ME-MS81D for Al, Zr and Sc).

Increased exposure to lithium

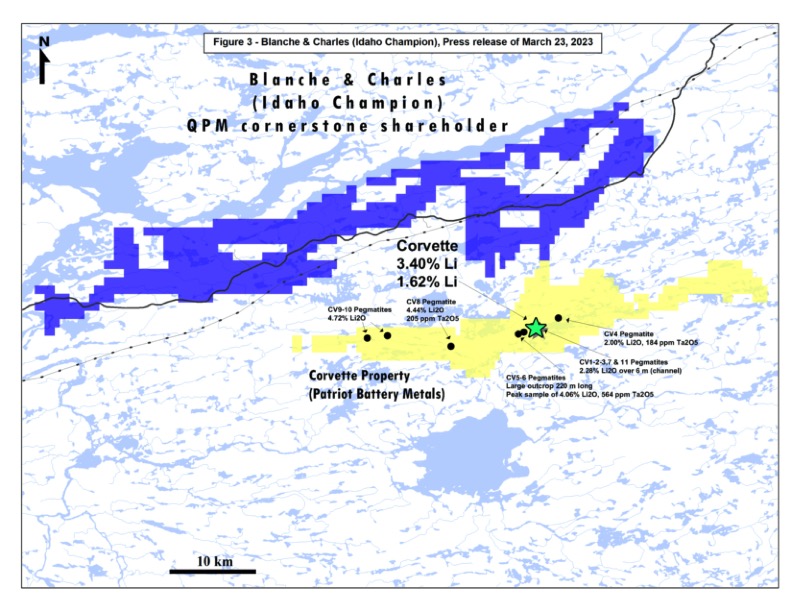

In addition to the lithium targets identified on its own projects, QPM owns 12 million shares of Champion Electric Metals Inc. (“Champion Electric”). These shares are currently valued at approximately $1.4 M and were received following the acquisition by Champion Electric in 2022 of the Blanche and Charles project located near Patriot Battery Metals’ lithium discovery on its Corvette project. Champion Electric controls 1,036 claims covering 529 km2 in the lithium-rich James Bay region and is currently carrying out an extensive surface exploration program.

Qualified Person

Normand Champigny, Eng., Chief Executive Officer of the Company, and Qualified Person under NI 43-101 on standards of disclosure for mineral projects, has prepared and reviewed the content of this press release.

About ALS GoldSpot

ALS GoldSpot is a Canada-based group of expert geoscientists and data scientists who utilize computational methods (such as Data Analytics, Machine Learning, and numerical modelling) to assist mining and exploration clients. ALS GoldSpot offers unique processes to focus exploration efforts, minimize client risk related to exploration targeting, and optimize aspects of conventional resource exploration workflows. Its diverse geoscience and data science technical teams combine proprietary technology with in-depth expertise in mineral exploration, mineral resources, and mining to offer robust and actionable solutions to its clients and partners. While mineral exploration and mining have become data-rich environments, the value of data is lost when datasets become so large that they cannot effectively be integrated into decision making. Its expertise and solutions target such big data problems, processing or integrating underutilized data to better comprehend resource property potential.

About Quebec Precious Metals Corporation

QPM is primarily focused on advancing its Sakami gold project, located in Eeyou Istchee James Bay territory in Quebec, near Newmont Corporation’s Eleonore gold mine. In addition the Company holds a 68% interest in the Kipawa/Zeus rare earths project located near Temiscaming, Quebec. This is the only rare earths project in North America which has a fully completed feasibility study.

For more information please contact:

Normand Champigny

Chief Executive Officer

Tel.: 514 979-4746

nchampigny@qpmcorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- April 28, 2025 Fury Gold Mines Completes Acquisition Of Quebec Precious Metals Corporation

- April 22, 2025 Quebec Precious Metals Announces Shareholder Approval of Arrangement with Fury Gold

- April 09, 2025 The Cree Trappers Association, the Cree Hunters Economic Security Board and Mining & Exploration Companies Approve 2025 Funding to Continue the Reconstruction of Cabins Burnt during the 2023 Forest Fires, James Bay, Quebec

- March 26, 2025 Fury Gold Mines and Quebec Precious Metals Update Merger Process

- February 26, 2025 Fury Gold Mines Limited to Acquire Quebec Precious Metals Corporation

- January 17, 2025 Quebec Precious Metals Receives Payment of $200,000 from the Sale of Non-Core Asset in Ontario

- November 26, 2024 Quebec Precious Metals Reports Consistent +20m Thick Spodumene-Bearing Pegmatite Up to 150m Deep from its Maiden Drilling Program on its 100%-owned Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- November 07, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- October 31, 2024 The Cree Hunters Economic Security Board, 16 Mining & Exploration Companies Contribute $750,000 For The Reconstruction Initiative Forest Fires Fund 2023, James Bay, Quebec

- October 30, 2024 Quebec Precious Metals Intersects 22.9 m of Spodumene-Bearing Pegmatite in the First Drillhole of its Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- October 21, 2024 Quebec Precious Metals Begins Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, Situated Near the Galaxy Project to be Acquired by Rio Tinto, James Bay, Quebec, Announces Private Placement

- September 19, 2024 Quebec Precious Metals Congratulates Harfang Exploration on its High-Grade Gold Discoveries near the Sakami Project and Provides Update on Gold and Lithium Exploration Initiatives in James Bay

- August 09, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- July 17, 2024 Quebec Precious Metals Announces Results of Annual Shareholders Meeting, Grants Deferred Share Units and Stock Options