Download PDF | View documents on Sedar

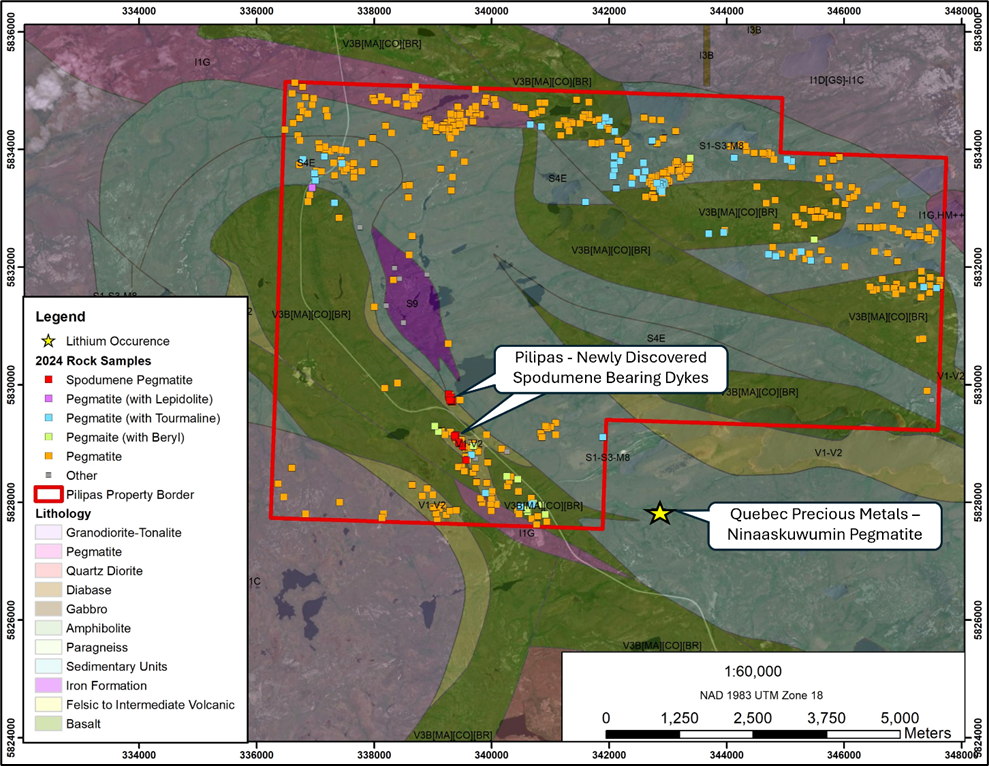

Montreal, October 21, 2024 – Quebec Precious Metals Corporation (TSX.V: QPM, FSE: YXEP, OTC-BB: CJCFF) (“QPM” or the “Corporation”) is pleased to announce the start of a maiden diamond drilling program (up to 1,250 m, 16 holes, HQ core size will be used) to test the down-dip extent of the sill of the discovery outcrop and the presence of potential stacked sills. Assay values from the nine samples from the discovery outcrop range from 1.10% to 3.92% Li2O.

Drill core samples and also rejects from the grab samples collected in 2023 will be used to carry out preliminary geometallurgical studies (see press release of January 18, 2024). These studies will be performed by Impact Global Solutions based in Delson, Quebec.

“We are very excited to execute this drilling program and test the potential size of our discovery and its extension on our project while investigating the geometallurgical characteristics of the lithium-bearing rocks.” commented Normand Champigny, CEO.

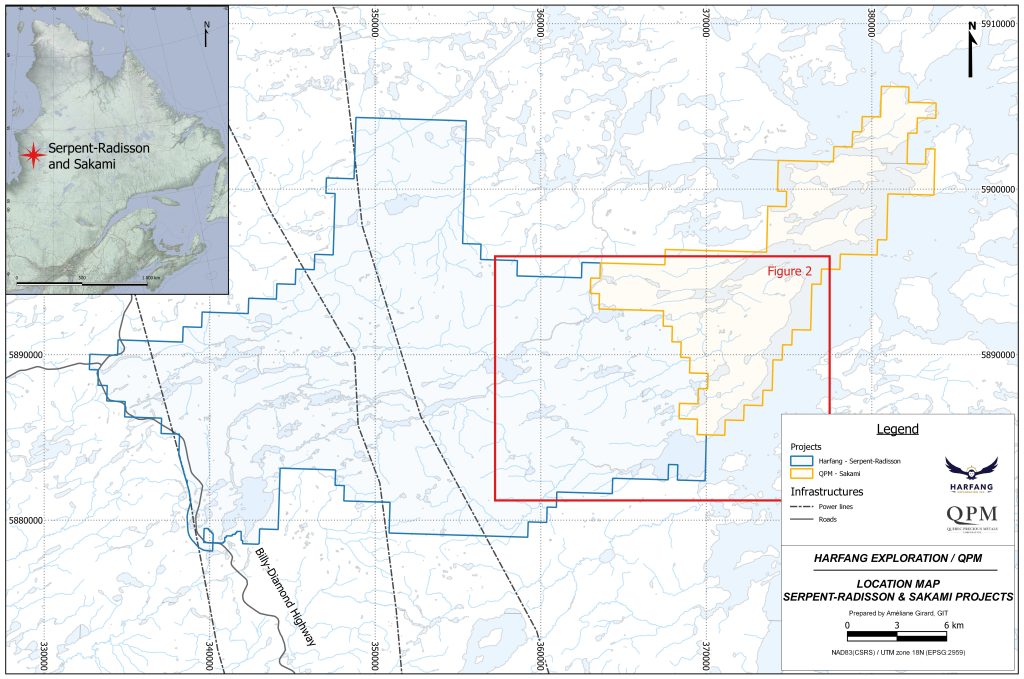

The Ninaaskumuwin lithium prospect is easily accessible from the paved Billy Diamond highway located about 50 km north of the ‘km 381’ rest stop that can provide accommodation, catering, fuel and power. It is also about 40 km north of the Galaxy project, which is being acquired by Rio Tinto plc as part of their recently announced acquisition of Arcadium Lithium plc for USD$6.7 billion (see Rio Tinto’s press release dated October 9, 2024).

QPM acknowledges the close collaboration of Power Nickel Inc. (TSXV: PNPN, OTCBB: PNPNF, Frankfurt: IVV) to secure a nearby drill to carry out the program (see photo below). GeoVector Management Inc., based in Ottawa, has been retained to perform the actual drilling program, which includes core logging and sampling of the drill core. The QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results. Drilling will be performed by RJLL Drilling, based in Rouyn-Noranda.

An updated corporate presentation is available on the Corporation’s web site www.qpmcorp.ca

Private Placement

Furthermore, the Corporation announces a non-brokered private placement of up to 12,500,000 units (the “Units”) at a price of $0.045 per Unit for gross proceeds of up to $562,500 (the “Offering”). Each Unit will be comprised of one common share (each a “Share”) and one half of one common share purchase warrant (each a “Warrant”). Each whole Warrant shall give the holder the right to purchase one common share of the Corporation (a “Warrant Share”) at an exercise price of $0.055 per common share for a period of 18 months following the closing of the Offering.

The Units will be offered by way of the “accredited investor” exemption under National Instrument 45-106 – Prospectus Exemptions in all the provinces of Canada. The Units, Shares, Warrants and Warrant Shares will be subject to a four-month hold period in Canada following the closing of the offering.

In accordance with TSX Venture Exchange policies, the Corporation is relying on a minimum price exception in order to issue securities at less than $0.05 per listed security. As such, the Corporation will not issue more than 100% of its issued and outstanding Shares pursuant to the offering.

The net proceeds from the sale of the Hard Units (“Funds”) will be used for exploration expenditures as well as general corporate and working capital purposes. No more than 10% of Funds are proposed to be paid to management, investor relations, or for a specifically identified purpose.

In connection with the Offering, the Corporation may pay finder’s fees and issue finder warrants to arm’s length finders, consisting of: (i) cash finder’s fees of up to 7 per cent of the gross proceeds of the offering; and (ii) finder warrants in an amount equal to up to 7 per cent of the number of Units issued pursuant to the offering, exercisable at a price of $0.055 per common share for a period of 18 months following the closing date.

Closing is subject to the approval of the TSX Venture Exchange and other customary closing conditions. There can be no assurances that the offering will be completed on the terms set out herein, or at all, or that the proceeds of the offering will be sufficient for the uses of proceeds as set out above.

Qualified Person

Normand Champigny, Eng., Chief Executive Officer of the Company, and Qualified Person under NI 43-101 on standards of disclosure for mineral projects, has prepared and reviewed the content of this press release.

About Quebec Precious Metals Corporation

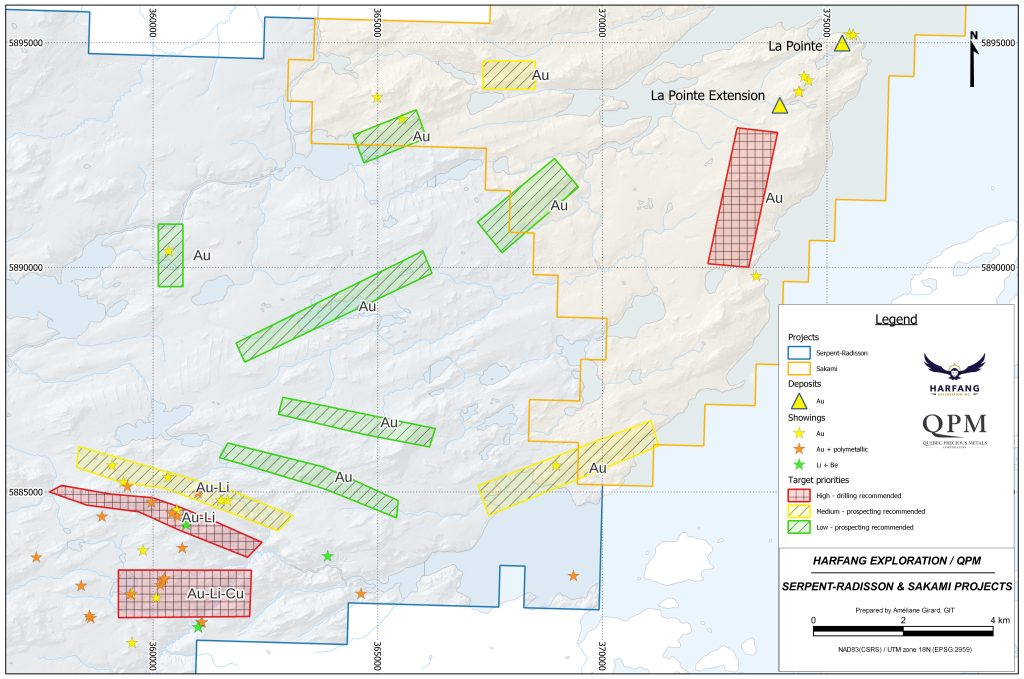

QPM has a large land position in the highly prospective Eeyou Istchee James Bay territory, Quebec, near Newmont Corporation’s Éléonore gold mine. The Corporation focuses on advancing its Sakami gold project and its newly discovered, drill-ready Ninaaskuwin lithium showing on the Elmer East project. In addition, the Corporation holds a 68% interest in the Kipawa rare earths project located near Temiscaming, Quebec.

For more information please contact:

Normand Champigny

Chief Executive Officer

Tel.: 514 979-4746

nchampigny@qpmcorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This release includes forward-looking statements. Often, but not always, forward-looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production output.

Forward-looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause actual results, performance and achievements to differ materially from any future results, performance or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of resources or reserves, political and social risks, changes to the regulatory framework within which the entity operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward-looking statements are based on the entity and its management’s good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect business and operations in the future. There are no assurances that the assumptions on which forward-looking statements are based will prove to be correct, or that the business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the entity or management or beyond the entity’s control.

Although there have been attempts to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward-looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be anticipated, estimated or intended, and many events are beyond the reasonable control of the entity. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements in this release are given as at the date of issue only. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information the entity does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based.

- April 28, 2025 Fury Gold Mines Completes Acquisition Of Quebec Precious Metals Corporation

- April 22, 2025 Quebec Precious Metals Announces Shareholder Approval of Arrangement with Fury Gold

- April 09, 2025 The Cree Trappers Association, the Cree Hunters Economic Security Board and Mining & Exploration Companies Approve 2025 Funding to Continue the Reconstruction of Cabins Burnt during the 2023 Forest Fires, James Bay, Quebec

- March 26, 2025 Fury Gold Mines and Quebec Precious Metals Update Merger Process

- February 26, 2025 Fury Gold Mines Limited to Acquire Quebec Precious Metals Corporation

- January 17, 2025 Quebec Precious Metals Receives Payment of $200,000 from the Sale of Non-Core Asset in Ontario

- November 26, 2024 Quebec Precious Metals Reports Consistent +20m Thick Spodumene-Bearing Pegmatite Up to 150m Deep from its Maiden Drilling Program on its 100%-owned Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- November 07, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- October 31, 2024 The Cree Hunters Economic Security Board, 16 Mining & Exploration Companies Contribute $750,000 For The Reconstruction Initiative Forest Fires Fund 2023, James Bay, Quebec

- October 30, 2024 Quebec Precious Metals Intersects 22.9 m of Spodumene-Bearing Pegmatite in the First Drillhole of its Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- October 21, 2024 Quebec Precious Metals Begins Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, Situated Near the Galaxy Project to be Acquired by Rio Tinto, James Bay, Quebec, Announces Private Placement

- September 19, 2024 Quebec Precious Metals Congratulates Harfang Exploration on its High-Grade Gold Discoveries near the Sakami Project and Provides Update on Gold and Lithium Exploration Initiatives in James Bay

- August 09, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- July 17, 2024 Quebec Precious Metals Announces Results of Annual Shareholders Meeting, Grants Deferred Share Units and Stock Options