Download PDF | View documents on Sedar

MONTREAL, Nov. 29, 2019 – Quebec Precious Metals Corporation (TSX.V: CJC, FSE: YXEP, OTC-BB: CJCFF) (“QPM” or the “Company”) is pleased to announce that it has closed the previously announced $6,500,000 bought deal private placement (the “Offering”). The Offering was conducted pursuant to the terms and conditions of an underwriting agreement entered into between the Company and a syndicate of underwriters led by Laurentian Bank Securities Inc., as lead underwriter and bookrunner, and including Canaccord Genuity Corp. (the “Underwriters”).

The Offering consisted of the issuance of 8,908,258 charity “flow-through” common shares of the Company (the “Charity FT Shares”) at a price of $0.40 per Charity FT Share, 7,105,517 Quebec “flow-through” common shares of the Company (the “Quebec FT Shares”) at a price of $0.29 per Quebec FT Share and 4,167,273 common shares of the Company (the “Hard Shares”) at a price of $0.22 per Hard Share, for aggregate gross proceeds of $6,540,703, which included an additional issuance of securities pursuant to the partial exercise by the Underwriters of an over-allotment option.

The net proceeds from the sale of the Hard Shares will be used by the Company for general corporate and working capital purposes. The gross proceeds received by the Company from the sale of the Charity FT Shares and the Quebec FT Shares will be used to incur Canadian Exploration Expenses (“CEE”) that are “flow-through mining expenditures” (as such terms are defined in the Income Tax Act (Canada)) on the Sakami project and other James Bay projects located in the Province of Québec, which will be renounced to the subscribers with an effective date no later than December 31, 2019, in the aggregate amount of not less than the total amount of the gross proceeds raised from the issue of Charity FT Shares and Quebec FT Shares.

In consideration for the services rendered in connection with the Offering, the Underwriters received a cash commission in the aggregate amount of $392,442. As additional consideration, the Corporation also issued to the Underwriters an aggregate of 1,210,863 non-transferable compensation warrants (the “Compensation Warrants”). Each Compensation Warrant is exercisable to acquire one common share of the Company at an exercise price of $0.30 at any time in whole or in part for a period of 24 months following the closing of the Offering.

All securities issued pursuant to this Offering will be subject to a restricted period expiring March 30, 2020, under applicable Canadian securities legislation. The Offering remains subject to the final approval of the TSX Venture Exchange.

QPM has been advised that Newmont Goldcorp Corporation (“Newmont Goldcorp”) has exercised its right to increase its ownership to 19.9% on a partially diluted basis by acquiring 4,407,808 common shares of the Company. This right had been granted to Newmont Goldcorp on April 25, 2018 pursuant to an Investor Rights Agreement with the Company.

Newmont Goldcorp had advised the Company that following the transaction, it now owns 10,541,042 common shares and 3,034,394 warrants, representing approximately 16.2% of the issued and outstanding common shares of QPM and 19.9% of the issued and outstanding share of QPM on a partially diluted basis. Prior to completion of the transaction, Newmont Goldcorp held 6,133,234 common shares and 3,034,394 warrants representing approximately 13.6% of the issued and outstanding common shares of QPM and 19.1% of the issued and outstanding common shares of QPM on a partially diluted basis. A copy of the Early Warning report filed by Newmont Goldcorp in connection with the transaction will be available on QPM’s SEDAR profile. Newmont Goldcorp’s head office is located at 6363 South Fiddler’s Green Circle, Suite 800, Greenwood Village, Colorado, 80111.

Some insiders of the Company, excluding Newmont Goldcorp, subscribed for a total of 592,718 Hard Shares of QPM. Participation by these insiders constitutes a related party transaction as defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The issuance of securities to the related parties is exempt from the formal valuation requirements of Section 5.4 of MI 61-101 pursuant to Subsection 5.5(b) of MI 61-101 and exempt from the minority shareholder approval requirements of Section 5.6 of MI 61-101 pursuant to Subsection 5.7(b) of MI 61-101. The Company did not file a material change report 21 days prior to the closing of the Offering as the details of the participation of these insiders of the Company had not been confirmed at that time.

About Quebec Precious Metals Corporation

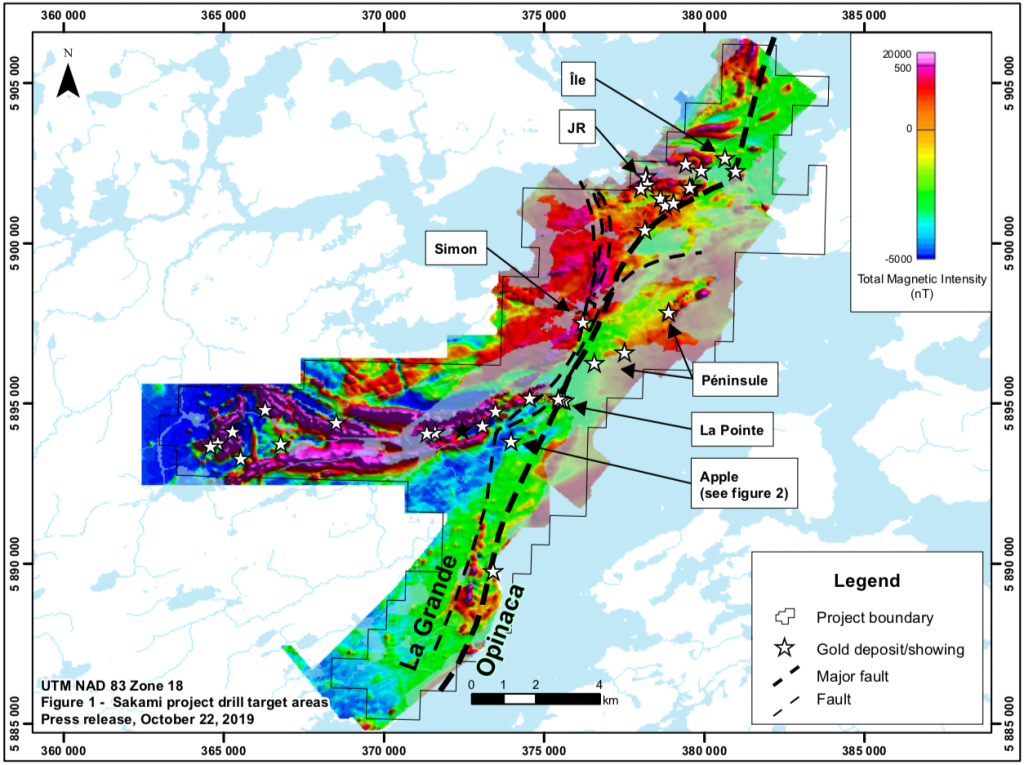

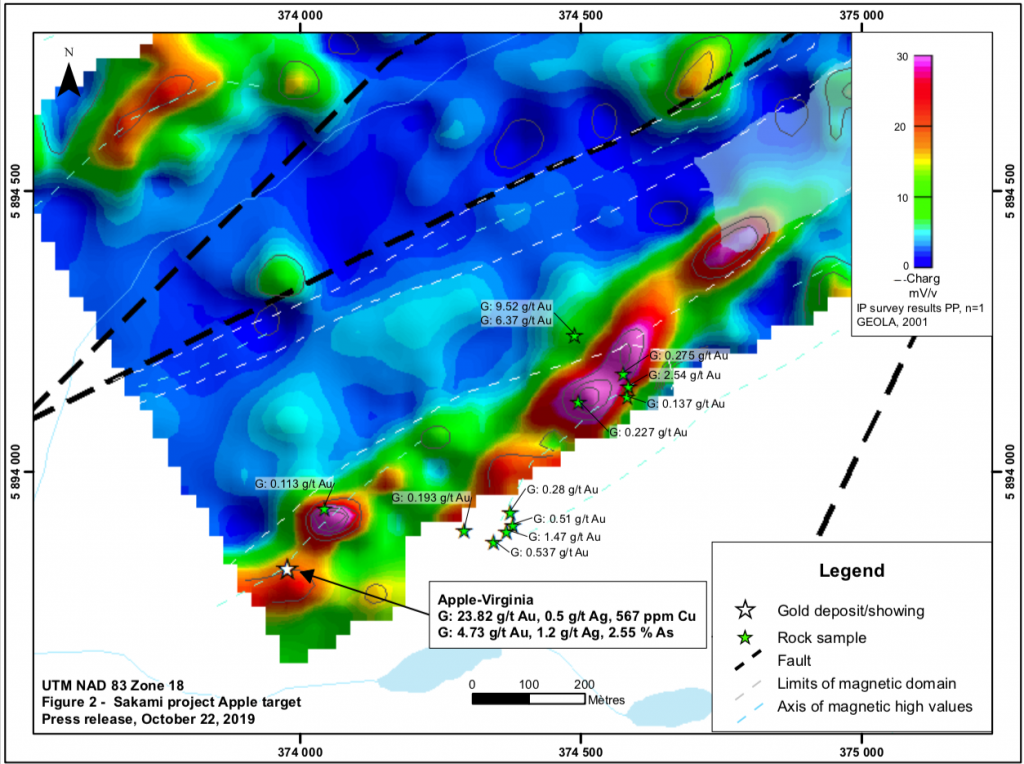

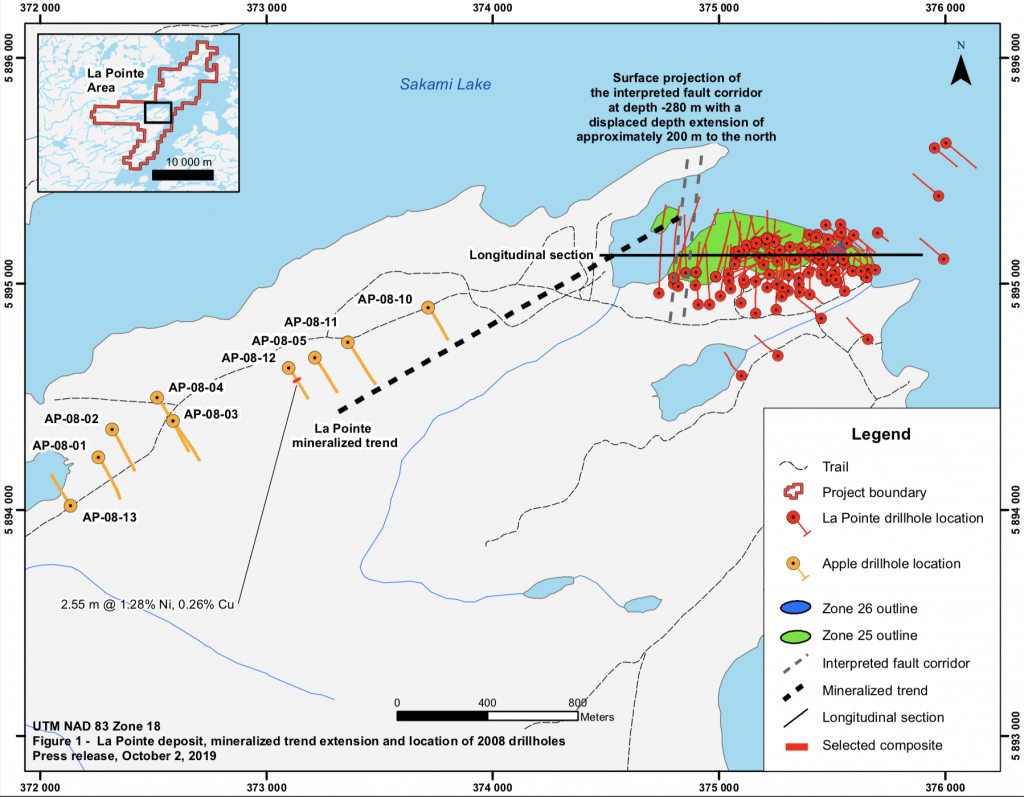

QPM is a gold explorer with a large land position in the highly-prospective Eeyou Istchee James Bay territory, Québec, near Newmont Goldcorp Corporation’s Éléonore gold mine. QPM’s flagship project is the Sakami project with significant grades and well-defined drill-ready targets. QPM’s goal is to rapidly explore this project to advance it to the mineral resource estimate stage.

For more information please contact:

Jean-François Meilleur

President

Tel.: 514 951-2730

jfmeilleur@qpmcorp.ca

Normand Champigny

Chief Executive Officer

Tel.: 514 979-4746

nchampigny@qpmcorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- April 28, 2025 Fury Gold Mines Completes Acquisition Of Quebec Precious Metals Corporation

- April 22, 2025 Quebec Precious Metals Announces Shareholder Approval of Arrangement with Fury Gold

- April 09, 2025 The Cree Trappers Association, the Cree Hunters Economic Security Board and Mining & Exploration Companies Approve 2025 Funding to Continue the Reconstruction of Cabins Burnt during the 2023 Forest Fires, James Bay, Quebec

- March 26, 2025 Fury Gold Mines and Quebec Precious Metals Update Merger Process

- February 26, 2025 Fury Gold Mines Limited to Acquire Quebec Precious Metals Corporation

- January 17, 2025 Quebec Precious Metals Receives Payment of $200,000 from the Sale of Non-Core Asset in Ontario

- November 26, 2024 Quebec Precious Metals Reports Consistent +20m Thick Spodumene-Bearing Pegmatite Up to 150m Deep from its Maiden Drilling Program on its 100%-owned Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- November 07, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- October 31, 2024 The Cree Hunters Economic Security Board, 16 Mining & Exploration Companies Contribute $750,000 For The Reconstruction Initiative Forest Fires Fund 2023, James Bay, Quebec

- October 30, 2024 Quebec Precious Metals Intersects 22.9 m of Spodumene-Bearing Pegmatite in the First Drillhole of its Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, James Bay, Quebec

- October 21, 2024 Quebec Precious Metals Begins Maiden Drilling Program on its 100% Owned High-Grade Lithium Ninaaskumuwin Discovery, Situated Near the Galaxy Project to be Acquired by Rio Tinto, James Bay, Quebec, Announces Private Placement

- September 19, 2024 Quebec Precious Metals Congratulates Harfang Exploration on its High-Grade Gold Discoveries near the Sakami Project and Provides Update on Gold and Lithium Exploration Initiatives in James Bay

- August 09, 2024 Quebec Precious Metals to Issue Shares in Payment of Services and Deferred Share Units

- July 17, 2024 Quebec Precious Metals Announces Results of Annual Shareholders Meeting, Grants Deferred Share Units and Stock Options